Trading Basics: Forex Risk Management

Forex trading gives buyers a lot of ways to make money on the global currency market. However, to do well in this market you need to know a lot about things like the size of the lots and how to handle forex risk management.

In this detailed guide, we’ll go over the two most important ideas in forex trading: lot size and risk management. This will give you the knowledge and tools you need to make smart decisions and improve your trading strategy.

What is Lot Size?

In forex trading, the amount or number of a currency pair that you trade at a certain time is called the “lot size.” It tells you how big your situation is and, in turn, how much you could win or lose. Standard lots, mini lots, and micro lots are the three main types of lot sizes.

Forex trading is a leveraged market, which means that traders can control large positions with relatively small amounts of capital. Therefore, it can amplify both profits and losses, making it important for forex risk management.

1.Standard Lots: A standard lot is equal to 100,000 units of the base currency.

If you are buying the EUR/USD currency pair, for example, a standard lot is worth 100,000 euros.

2.Mini Lots: A mini lot is 10,000 units of the base currency, which is one-tenth the size of a standard lot.

Traders who want to limit their risk and exposure often choose mini lots.

3.Micro Lots: A micro lot is one-tenth the size of a mini lot and has 1,000 pieces of the base currency.

Micro lots are good for traders who don’t have a lot of money or who want to try out their strategies with smaller amounts.

Here’s how you do it:

Imagine you have $1,000 in your forex trading account, and you want to trade the EUR/USD currency pair. Here’s how you can use forex risk management and lot size calculator-

Step 1: Decide on Your Risk Percentage

Firstly, you decide that you’re willing to risk 2% of your trading account on this trade. This means you’re willing to lose up to $20 (2% of $1,000) if the trade goes against you.

Step 2: Set Your Stop-Loss

Secondly, you analyse the market and determine that a reasonable place to set your stop-loss is 50 pips away from your entry point. A “pip” is a tiny change in the exchange rate.

Step 3: Calculate Your Risk According to Balance

Thirdly, to calculate how much money you’re risking on this trade, you multiply your risk percentage by your account balance. In this case, it’s 2% of $1,000, which equals $20. So, you’re risking $20 on this trade.

Step 4: Determine Lot Size

Finally, you need to figure out how many units of the EUR/USD currency pair you can trade to risk only $20. This is where the lot size comes in.

The formula for lot size calculation is:

Lot Size = (Monetary Risk) / (Stop-Loss in Pips x Pip Value)

However, let’s calculate pip value.

Pip Value Calculation:

The pip value depends on the size of your trade and the currency pair you’re trading. In the case of the EUR/USD pair, if you’re trading a micro lot (1,000 units), the pip value is approximately $0.10 for one pip movement. Now, use the formula to calculate the lot size:

First, Lot Size = ($20) / (50 pips x $0.10/pip),

then, lot Size = ($20) / ($5)

Therefore, Lot Size = 4 mini lots

So, to risk only $20 on the EUR/USD trade with a 50-pip stop-loss, you should trade 4 mini lots (or 40,000 units).

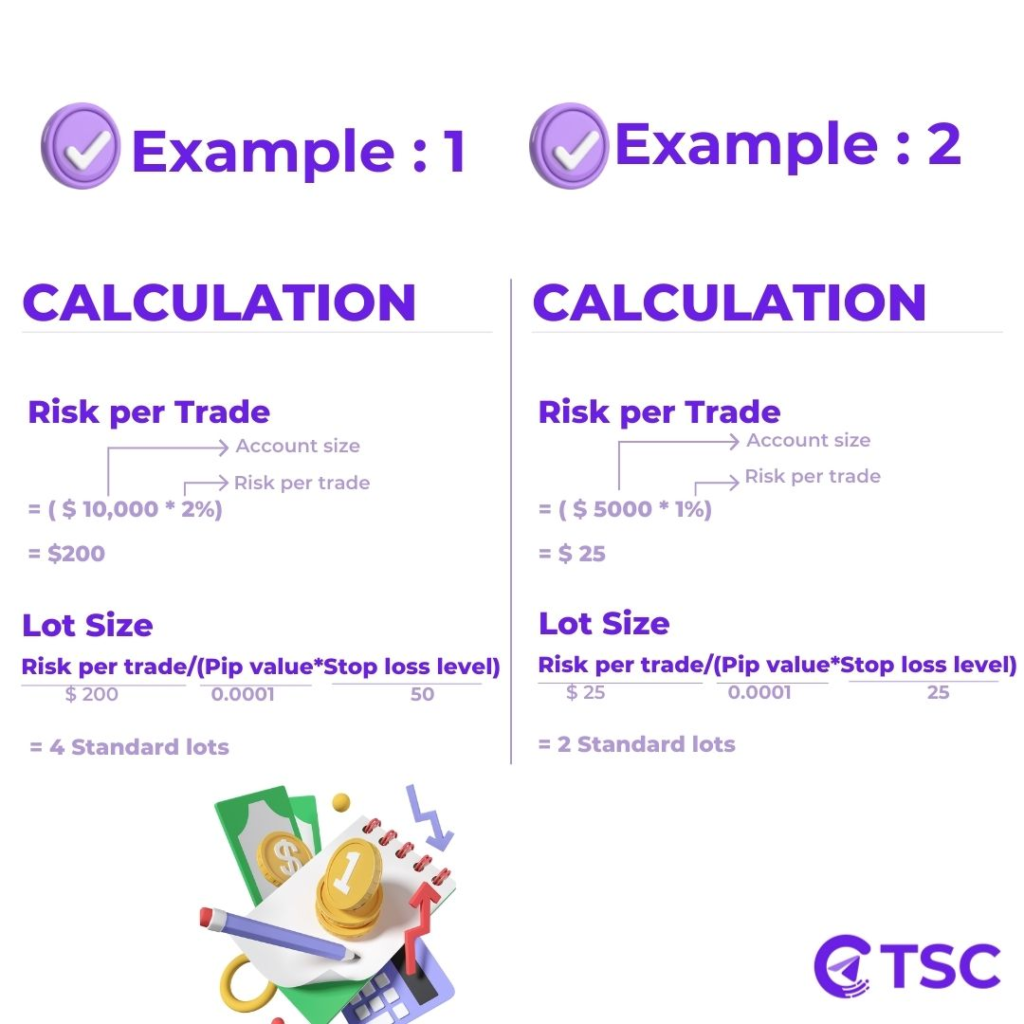

This means that if the trade goes against you, and the price moves by 50 pips, you will lose approximately $20, staying within your predefined risk limit of 2% of your trading account. We are inserting two more examples for your clear ideation:

Risk Management Rules

A good rule of thumb is to never risk more than 2% of your trading account on a single trade. This means that if you have a $10,000 trading account, you should not risk more than $200 on any one trade.

Another important risk management rule is to use diversification. Diversification means spreading your risk across different currency pairs and different trading strategies. This will help to reduce your overall risk if one trade or one strategy goes against you.

Here’s what you do: You can’t buy too many apples because that might make you lose more than $10 if they go bad. So, you buy just 20 apples. Now, every time you buy apples (trade), you’ll buy 20 of them. If the apples’ prices fall and you lose 50 cents per apple, you won’t lose more than $10. That’s how you keep things safe.

- Using Risk-Reward: Sometimes, you might say, “If I can make more money, I’m okay with taking a bit more risk.” It’s like saying, “If I can make $20 instead of just $10, I’ll take the chance.” That’s where “risk-reward” comes in. It’s about balancing how much you might lose with how much you might make. For example: – If you’re okay losing $10, but you want to make $20, it’s like saying you’ll sell your apples when they’re worth $2 each (twice what you paid).

- Tools for Lot Sizing and Risk Management: Many forex trading systems have built-in calculators and tools for figuring out how many lots to trade and how much risk to take. These tools make it easy to figure out the right lot size based on how much risk you are willing to take and where you want to put a stop-loss.

How TSC Telegram Copier Helps in Risk Management:

TSC Telegram Copier has various features that make FOREX risk management easier. Here’s how our trusty hero shines-

1. Lot Calculations: You can easily set your lot size according to your balance or you can let TSC copier automatically calculate your lot size according to your account balance by using dynamic lot calculator. Not just that, if your telegram signals have more than one TP, you can set the TSC copier to split your fixed lot or risk equally among multiple TPs or ignore TP based on your choice.

2. Trade Management: One of the most important factors of Forex risk management is managing your signals properly. TSC forex copier offers Auto spread calculation and SL TP override mode- where you can set SL/TP of your signals based on your choice. You also get features such as- ignoring trades with no SL/TP, same entry price of the same pair and choosing if you want to hedge or not.

3. Risk Management: TSC forex copier offers so many useful features in the risk management section. There are no other telegram copiers that will provide you this many features.

**Our telegram copier can Move SL to Entry Price on your signal command or you can set up number of pips after which our TSC copier will move your SL.

**With Telegram Signal Copier you are able to set percentage of lots you want for close half and partial commands

**You can use trailing SL and additionally a trailing TP feature that will help you secure your money even more with Telegram signal copier.

Here are some additional tips for managing risk in forex trading:

- Use a trading journal to track your trades and identify areas where you can improve.

- Backtest your trading strategy on historical data before using it in a live trading account.

- Use a demo account to practise your trading skills before risking any real money.

- Never trade with money that you cannot afford to lose.

- Use micro lots when first starting out to minimise risk per trade until you gain experience.

- If a currency pair is highly volatile with larger price swings, use smaller lot sizes.

- Properly placed stop losses are vital for limiting downside risk.

- As your account grows, incrementally increase lot sizes to boost returns.

- Remember the pip value increases with larger lot sizes which impacts risk per trade.

Conclusion:

In forex, it is very important to choose the right size of lot and manage risk per trade. By using good risk management, you can increase the size of your lots as your account grows. Stick to a maximum risk of 1-2% per trade and choose the right lot size. This will help you learn how to handle your money and become a great forex trader in the long run.

Remember that the case is simplified, and trading in real life may involve more factors and things to think about. Risk management is important, and you need to know how your chosen trading site works.

Happy Trading. Stay with TSC!