Sometimes, due to slippage in Forex Trading, a trade executes as a pending order even if it is meant to be a market execution order. To fix trade signal price mismatch, Telegram Signal Copier introduced Market Order and Pips Tolerance for Market Execution options.

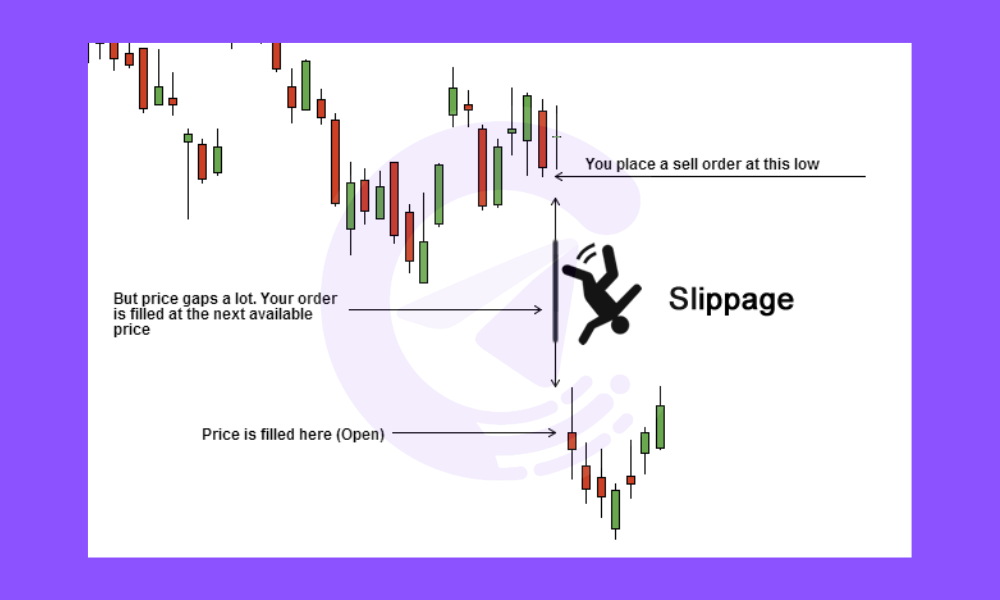

Understanding Slippage in Forex

Slippage in forex occurs when a market order is executed, or a stop loss closes a position at a rate that differs from the rate specified in the order.

Note that, Slippage is more likely in the forex market when volatility is high, such as after a news event, or when the currency pair is trading outside of peak market hours.

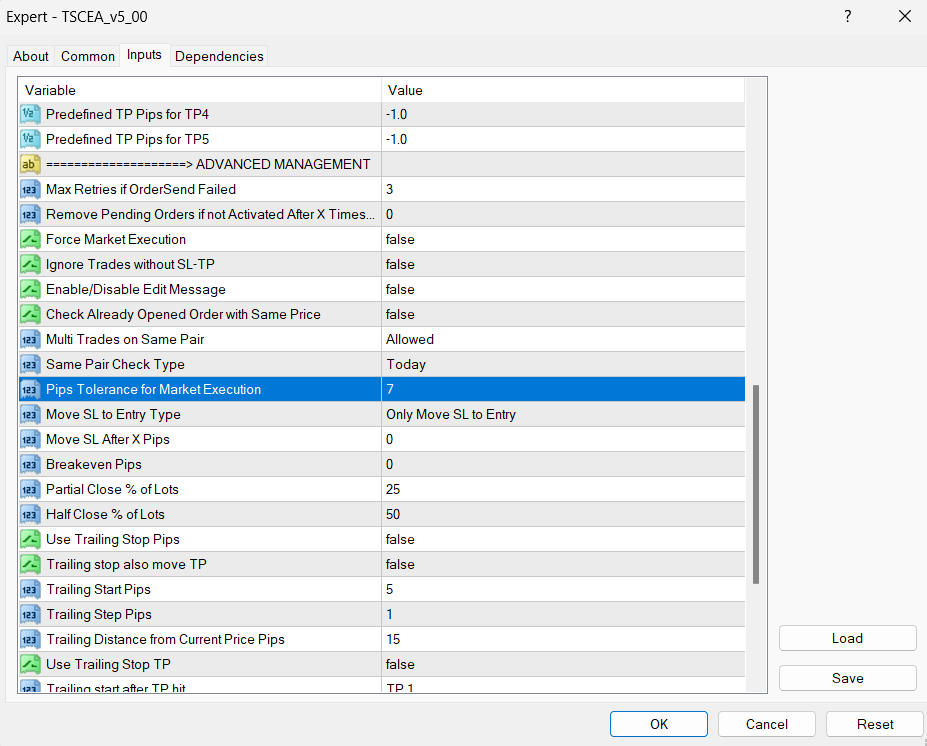

How to Set Slippage in TSC?

To execute trade at market price, open your EA settings, scroll down and select the Pips Tolerance for Market Execution option. Depending on your signal provider you can set it 7-15 or according to your preference.

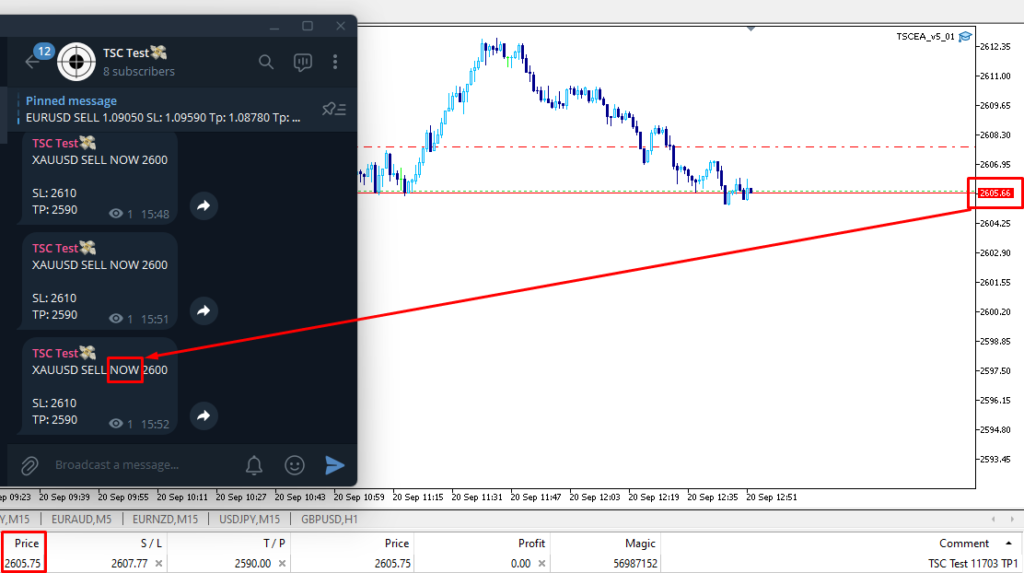

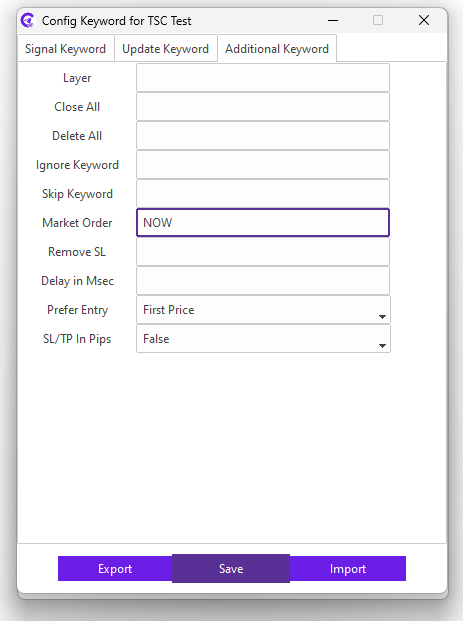

Telegram Signal Copier Market Execution Feature:

This option in TSC Copier will help you to execute trade at market price regardless the price mentioned in the signal.

For example: Our signal provider commands NOW keyword for the market order, but the price is not a market price. So, we need to enter NOW keyword in the Market Order field for market execution

In this way, your issue with the signals provider’s price not matching with the market price will be solved easily.

You can check out our other resources, if you have more questions lingering about Telegram Signal Copier EA. You can reach our 24/7 support too!

Suggested articles:

Can I exclude any pairs if I don’t want to trade?

How to set predefined SL & TP pips in TSC if not provided?

How to set my targeted pips to close half trade & move SL to entry?

Can I set how much I want to close on the partial close update?