How to Reverse Trading Signals to Profit from a Losing Trade

“Trades from my signal providers always go in the opposite direction!!” – Ever come across such a situation? Then, you’re not alone. This is where reverse trading works as a game-changer.

Whether you stumbled into a bad signal provider or the market always moves in the opposite direction of your signals, you can turn dust into gold simply by using a reverse trading EA.

Yes, it’s possible, and in this blog post, we will have a deep dive into reverse trade copier, its benefits, and how to turn a losing trade into a winning one using this feature.

- Reverse trading is an automated trading solution for signal copiers to profit from underperforming trade signals.

- Reverse trading can be profitable for consistent bad signals.

- Reverse trading is completely different from reversal trading, which is a manual trading style.

What Is Reverse Trading in Copy Trading?

Reverse trading is an automated trading strategy where your copier automatically executes the opposite of the trades sent by a signal provider. If the signal provider buys, your trade account automatically sells. If they sell, your account buys. The core idea behind reverse copy trading is to profit from a losing trader.

For your information, it’s not the same as “reversal trading,” which is a trading strategy based on price trends. It’s more about mirroring unsuccessful trades to profit.

Simply put, reverse trade copy means if your signal provider says ‘BUY’, your trade executes as a ‘SELL’, and vice versa.

So, a reverse copy signal works the same as any signal copier does. The only difference is that instead of following the signal provider’s Buy/sell order, the reverse copier flips the order. And it applies to any type of trade order.

Why Reverse Trading Can Be a Smart Strategy for Trade Copiers?

To turn a losing trade strategy into a winning one, reverse trading plays a crucial role. This strategy aims to profit from consistently underperforming traders by flipping their “incorrect” moves.

Some other potential reasons include-

• Profiting from Losing Trades

If you find your signal provider continuously sending signals for losing trades, reversing the trades might have a chance of turning the losses into profits, which is called a contrarian trading strategy.

• Testing & Identifying Bad Providers

To test your signal provider’s strategy, reverse copy trading is effective. According to a subreddit discussion, 90% of retail traders lose money due to bad signal strategies. Using reverse copy trading, you can easily test and identify a bad signal provider and reverse their losing trade signals to profitable ones.

• Exploiting Emotional Biases

Reversing trades might help to exploit situations where irrational trading signals are generated. By automating the opposite of such trading psychology or herd-driven trading signals, you can leverage logic over impulsive trades.

• Built-in Hedging

Reverse signal mode can be helpful if you want to reverse only a few trades to balance your risk on specific currency pairs, resulting in a diversified portfolio.

• Customize Risk

Scalpers and prop traders who want more control on their trades or want to test new strategies, reverse trading can be useful to customize the risks.

What Happens When You Reverse A Trade?

When you reverse a trade, you place a trade in the opposite position of the original trade (BUY becomes SELL and vice versa), converting the risks into potential profits. As a result, this changes the entire trade order, SL/TP, and risk-reward ratio.

As mentioned, in reverse trading, the order direction is reversed, and the trade is placed in the opposite direction. For example, your signal provider sends a trade signal in forex as follows-

“AUDUSD BUY 0.65143

SL: 0.65023

TP: 0.6356”

With reverse trading mode, the trade will be placed as follows-

“AUDUSD SELL 0.65143

SL: 0.65356

TP: 0.65023”

Here, the buy trade in forex signal gets flipped and executed as a sell trade; as a result, the SL turns into TP, and the TP turns into SL.

This is the general rule of thumb to reverse a trade. However, if the copier comes with some other feature to customize a reverse trade, such as the Telegram Signal Copier, you can leverage more benefits.

So, overall, the reversed trade should be as below-

And what if the original signal comes with multiple TP?

In that case, multiple trades will be opened, flipping the SL and TP. In fact, if there are multiple TPs, the reversed trade will be opened with multiple SLs.

When Should You Use Reverse Trading to Reverse Copy Trade?

To turn a bad signal into a profitable trade, you should use a reverse trade copier. Besides, scalpers to trade in News scalping can reverse their trades to catch trend reversals.

Let’s assume, after a long time of observing and analyzing your signal provider, you might find out that every time the trade your signal provider sends, the market goes in the opposite direction. And you wish you could flip the trade signal and make some profits.

Sometimes you regret that you could have turned those SL into TP if the buy order had been placed instead of the sell order. If you ever feel like this, then the reverse trading signal copier is for you.

However, to test trading strategies, reverse trading helps to compare the results with the original trades. Besides, reverse copy trading also helps to take opposite trades during high volatility.

How Telegram Signal Copier Makes It Easy with Dual Reverse Trading Options

Telegram Signal Copier offers two reverse trading modes: reverse SL/TP or reverse based on pip values, giving traders control and customization to profit from a losing trade.

Telegram Signal Copier (in short, TSC) is the best reverse trade copier in 2025. It is the only reverse copy trading tool with dual reverse trading modes. While other signal copiers just copy the signals or flip the signals, Telegram Signal Copier takes a step ahead and helps to dig gems out of dust.

How?

TSC offers 2 smart modes to reverse trade signals, ideal for MetaTrader 4 (MT4)/MetaTrader 5 (MT5), cTrader, DxTrade, etc. So, no matter the purpose of the reverse trade, you can auto reverse trade copying signals with your preferred profit and loss customization.

2 Modes of TSC reverse trading are-

1. Reverse Signal:

In this mode, the original trade is reversed along with the TP and SL. It means-

BUY ⇌ SELL

SL becomes TP

TP becomes SL

For Example:

⇒Original Signal:

BUY EUR/USD

SL: 1.0950

TP: 1.1050

⇒Reversed Trade:

SELL EUR/USD

SL: 1.1050

TP: 1.0950

2. Reverse Signal in Pips

In this mode, the trade signal is reversed, maintaining the same pip difference between the entry point, SL, and TP. it means when you turn this feature true, the SL-TP of your trade will be reversed based on the pip differences, not any random flip.

For Example:

⇒Original Signal:

XAUUSD BUY 3000

SL: 2000.0

TP: 5000.0

⇒Your Reversed Trade:

XAUUSD SELL 3000

SL: 4000.0

TP: 1000.0

Here, the trade order is flipped, not the SL-TP. SL-TP is changed based on the pip difference.

Traders who like to work with pip values, this mode of reverse trading seems to be profitable.

How to Set Up Reverse Trading in Telegram Signal Copier (Step-by-Step)

Setting up the TSC reverse signal option requires a simple setting inside the TSC EA (Expert Advisor). Here are the steps for that-

Step 1: Open the TSC EA

In your trading platform, such as MT4/5 or cTrader etc. open the TSC EA. MetaTrader user, double‑click the smiley/cap icon on the chart and open the EA file.

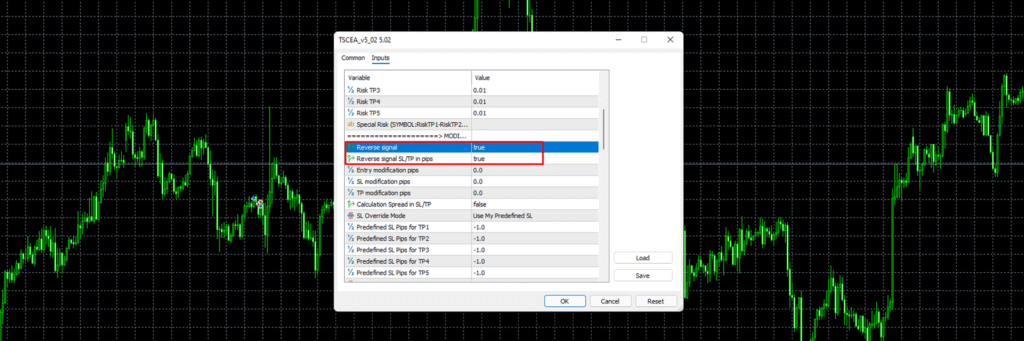

Step 2: Scroll Down & Find Reverse Signal

Now, under the ‘Inputs’, scroll down and find the reverse signal option.

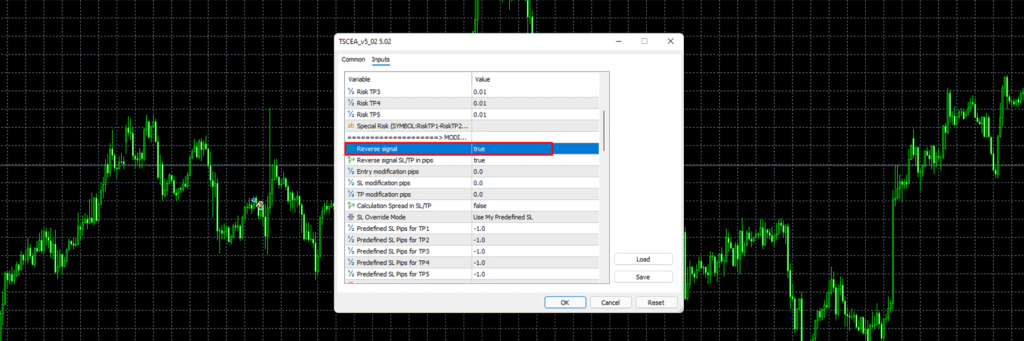

Step 3: Make Reverse Signal True

Double-click on the reverse signal option and make it true. If it is kept false, it will normally copy trade signals. But if you make it true, every trade from the selected Telegram channel will be reversed.

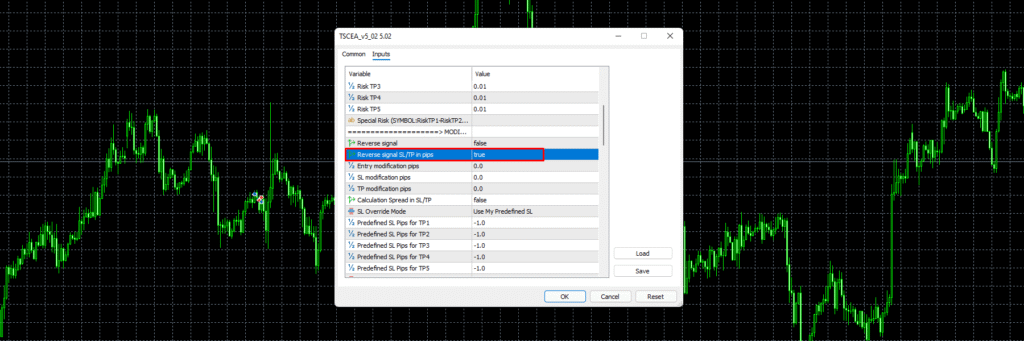

Step 4: Reverse Signal SL/TP in Pips

This is another reverse mode in the TSC trade copier software to reverse pip-based execution. Now, if you want your signals to be reversed based on the pip value, then double-click the next option- ‘reverse signal SL/TP in pips.’ Make it true.

Now, every trade from the selected Telegram channel on this EA will be reversed, maintaining the pip differences from the entry point.

If you don’t want the reverse copy trading to be executed based on pip value, then make this option false. And just keep the reverse trading option true. And it will reverse the trades, including SL and TP.

Step 5: Save & Apply

Now, click Ok and check your reverse copy trading.

Key Benefits of Using TSC to Reverse Copy Trading

The TSC reverse copy trading option helps to flip trades automatically and turn a losing trade into a winning one without lifting a finger. Here are the key benefits of this Telegram trade copier-

• Using poor-performing signal providers as a reverse indicator and protecting your capital.

• Turn a bad signal provider’s trade into a good one.

• Test different trading strategies, especially for funded accounts for prop traders.

• Easily reverse copy trading, mirroring pip-based logic.

• Quick & hassle-free setup, no coding or tech jargon.

• Ideal for beginners to professionals following Telegram signals.

• Suitable for prop traders and scalpers.

• Compatible with every trading platform.

• Helps to counter overhyped trades with emotional biases.

• Can reverse any signals from any Telegram channel or group.

• 24/7 active support team for any kind of assistance.

So, use the TSC reverse trade copier to copy trade signals and turn them into profitable trades.

Risks of Using Reverse Copy Trading

Reversing trade copy from a signal provider whose signals are well analyzed and around 60% accurate can lead to potential risks and losses. You should not use a reverse trade copier for any random signals.

If you reverse the trading signals from expert traders, it may lead to more losses than profits. Also, reverse trade is not suitable for strong trending markets.

So, it is not recommended to use reverse signal mode unless you are assured that the signals from your signal providers always go in the opposite direction. Reverse trading should be used for underperforming signals or testing purposes.

Reverse Trading Vs Reversal Trading: Key Differences Summarized

Reverse trading copies trades in reverse positions, whereas reversal trading is to trade a trend reversal pattern. So, reverse copy trading is not the same as reversal trading—don’t confuse them.

Closing Thoughts

In the world of trading, innovation is the key to staying ahead of the curve. With an advanced copy trading technique, like reverse trading, Telegram Signal Copier makes your trading smarter, more advanced, and more profitable, even with the bad signal providers.

Whether you are testing different trading strategies or you happen to come across a bad signal provider, TSC’s auto-reverse trading feature with dual-mode options is here for you.

Use this automated trade copier with reverse mode not just to get a backup but to make it a strategy to get control and get profitable performance even out of bad signals. Contact TSC support to learn more.

FAQs

Yes, reverse trading is profitable when applied to the underperforming trade signals. Besides, scalpers and prop traders use reverse trading to test different strategies and profit from reverse trading.

Telegram Signal Copier is the best reverse trading tool with a dual-mode reverse signal feature.

Yes, the TSC reverse trading feature automatically affects the SL and TP and reverses them during trade execution. You just need to make the feature true to reverse trades.

Yes, reverse trading is safe for a prop firm trading to test different profitable strategies.

Yes, you can easily copy reverse trades using the Telegram Signal Copier reverse trading feature.

No, you can’t reverse only certain signals or pairs from the selected channels in your EA. If you need to, you can keep those certain channels in the TSC EA that you want to reverse trades on. And only those reversed trades will be running on your account.

Reverse position in trading means to close an existing trade and open a new trade in the opposite direction of the closed trade. It is applicable for manual trading and is different from the reverse trade copy.

4 Comments