How to Use a Custom Trailing Stop for Profit? How to Set it Up in TSC?

In modern trading, profits are not made only by entering the right trades—they are protected by exiting them intelligently. This is where trailing stop loss strategies play a decisive role. A trailing stop allows traders to lock in profits dynamically as price moves in their favor, instead of relying on fixed stop-loss levels.

A custom trailing stop takes this concept further. Instead of using generic point-based rules, traders can tailor exit logic based on take-profit levels, partial closures, volatility behavior, or smart profit-locking rules. When combined with automation tools like Telegram Signal Copier (TSC), custom trailing stops become a powerful profit-protection engine.

In this guide, you’ll learn how custom trailing stops work, why traders prefer them over standard trailing stops, and exactly how to set them up in TSC for disciplined, automated profit management.

What is a Trailing Stop in Forex Trading?

A trailing stop in forex trading is a dynamic stop-loss order that moves automatically as the market price advances in your favor. Unlike a static stop loss, which stays fixed after trade entry, a trailing stop “trails” price movement at a predefined distance or rule.

The core purpose of a trailing stop loss is simple:

protect trading profits while still allowing room for price expansion.

How Does a Trailing Stop Work?

The trailing stop mechanism automatically adjusts your stop-loss level based on price movement tracking. In practice, a trailing stop helps traders balance two competing goals—maximizing profit potential and minimizing downside risk—making it a core tool for both beginner and professional traders.

For example, if you enter a buy trade and price rises, the trailing stop moves upward with the market. If the market reverses by a predefined distance, the trade closes, securing your gains.

Key characteristics of trailing stops include:

- Moving stop loss that follows favorable price action

- Automated profit protection without constant monitoring

- A dynamic exit strategy that adapts to market behavior

Unlike static stop-loss orders, trailing stops reduce emotional trade management and help traders stay consistent.

Why is a Trailing Stop Important in Forex Trading?

A trailing stop is important in trading because it protects profits automatically while allowing winning trades to continue as long as the market moves in the trader’s favor. Unlike a fixed stop-loss, a trailing stop adjusts dynamically with price movement, locking in gains without requiring constant manual monitoring.

This is especially valuable in volatile markets like Forex and crypto, where prices can move fast and reverse unexpectedly. By trailing the stop behind price, traders reduce emotional decision-making, avoid premature exits, and enforce disciplined risk management.

Key benefits of using a trailing stop in trading:

- Profit protection: Automatically secures unrealized gains as price moves favorably.

- Reduced emotional trading: Eliminates fear-driven exits and overthinking.

- Hands-free trade management: Ideal for automated trading, signal copying, and busy traders.

- Adaptability to volatility: Adjusts to market movement instead of relying on static levels.

What is the Difference Between a Standard Trailing Stop and a Custom Trailing Stop?

The key difference between standard and custom trailing stops lies in flexibility and control over trade management. A standard trailing stop is pre-set by the trading platform, moving automatically at a fixed distance from the current market price. In contrast, a custom trailing stop allows traders to define precise parameters, such as distance, step size, and conditions for activation.

This customization enables more sophisticated risk management, adapting to market volatility, trading style, or asset-specific behavior. For instance, Forex traders can adjust a custom trailing stop to follow price swings more closely in volatile currency pairs or set it wider for long-term trend trades, maximizing profit potential without being stopped out prematurely.

Benefits of custom trailing stops over standard ones

- Greater flexibility: Traders can tailor the stop distance and behavior to market conditions.

- Improved profit optimization: Enables following trends longer without unnecessary exits.

- Advanced risk management: Adapts to volatility and trading strategies effectively.

- Compatibility with automation: Works seamlessly with signal copiers and expert advisors.

Why Do Traders Use Custom Trailing Stops?

Traders use custom trailing stops to gain precise control over trade management, allowing them to protect profits while maximizing the potential of winning trades. Unlike standard trailing stops, custom versions can be adjusted to suit specific market conditions, trading strategies, or volatility levels, giving traders the flexibility to react intelligently rather than mechanically.

Key reasons traders prefer custom trailing stops:

- Tailored risk management: Aligns with individual strategies and market behavior.

- Maximized profit potential: Allows trades to ride favorable trends longer.

- Automated trading compatibility: Supports hands-free execution with signal copiers and EAs.

- Reduced emotional trading: Prevents impulsive exits and enforces discipline.

This is particularly useful in Forex and cryptocurrency markets, where price movements can be rapid and unpredictable. By setting custom parameters—such as trailing distance, step increments, and activation points—traders can let profitable trades run longer during trends while limiting losses when the market reverses.

Additionally, custom trailing stops reduce emotional decision-making, enforce disciplined risk management, and integrate seamlessly with automated trading tools like Telegram signal copiers and expert advisors, making them ideal for both active and hands-free trading.

What is Telegram Signal Copier (TSC)?

A Telegram Signal Copier (TSC) is an advanced trading tool that automatically copies trade signals from Telegram channels directly into trading platforms such as MT4, MT5, cTrader, DXTrade, and TradeLocker. It is designed to simplify the trading process by eliminating the need for manual execution, ensuring traders can act on signals instantly and accurately.

TSC supports a wide range of signal formats—including text-based instructions, formatted messages, images, and multi-language signals—making it compatible with nearly any Telegram trading channel. By automating signal execution, it saves time, reduces human errors, and allows traders to manage multiple accounts or channels simultaneously.

For both beginner and professional traders, a Telegram Signal Copier enhances efficiency, enables hands-free trading, and maximizes the potential of following expert traders without constant monitoring.

Why Do Traders Choose Telegram Signal Copier (TSC)?

Many traders choose Telegram Signal Copier because it offers advanced automation features beyond simple signal copying. Key reasons include:

- Maximized profits through features like trailing stops and smart profit locking

- Fully automated trading, eliminating constant monitoring

- User-friendly interface, suitable for beginners and professionals

- Time efficiency, allowing traders to focus on strategy instead of execution

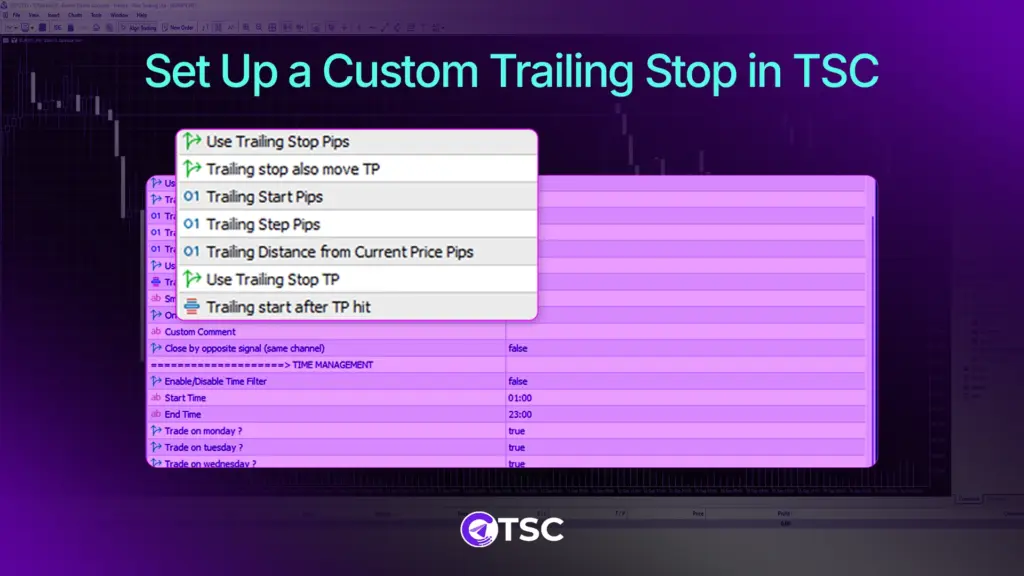

How to Set Up a Custom Trailing Stop in TSC?

Setting up a custom trailing stop in TSC is a structured process, which makes it ideal for automated risk management.

TSC Custom trailing works based on 2 modes-

1. Use Trailing Stop Pips:

When it is set to ‘true’, TSC is ready to trail and move the SL of the trade based on your given pips. If you want to move your take profit levels at the same time, you can also enable the option- ‘trailing stop also move TP’.

3 parameters work for this pip-based trailing-

Trailing Start Pips– For setting the number of pips to start trailing

Trailing Step Pips– For the recurring steps, based on what the trailing will be continued

Trailing Distance from Current Price Pips: To set the pip difference from the market price while trailing

2. Trailing Start TP:

When this trailing feature is set to ‘true’, your trailing will start based on the TP hit. And you can set from which TP (TP1-TP4) hit, you want the trailing starts from the option below- ‘Trailing start after TP hit’.

For example, for a buy trade, you select TP2 to activate trailing after the second take-profit level is reached. When TP2 is hit, a new trade is opened, where the last SL becomes the TP1, and trailing continues.

This approach ensures trailing starts only once the trade proves itself.

Click OK to save your configuration. Run a demo or backtest to observe behavior under live-market conditions. This step is critical for validating stop-loss configuration logic before scaling.

What are the Common Mistakes to Avoid When Using Custom Trailing Stops?

Even with automation, traders can make errors that reduce performance. Common mistakes include:

- Setting the stop loss too tight, leading to frequent stop-outs

- Ignoring market volatility when defining trailing distances

- Over-optimization, which fails in real market conditions

- Changing rules mid-trade due to emotions

Avoiding these trailing stop mistakes helps maintain a consistent exit strategy and reduces emotional interference.

Final Takeaways

Custom trailing stops transform trade exits from reactive decisions into structured systems. When paired with Telegram Signal Copier, they deliver fully automated trade management with professional-grade discipline.

The real advantage is not just higher profits—it’s consistency. Automated trailing logic enforces trading discipline, protects gains, and allows strategies to scale without emotional friction.

Serious traders don’t rely on hope or instinct. They rely on systems, testing, and refinement. Custom trailing stops in TSC offer exactly that path toward long-term performance optimization and professional trading habits.

FAQS

Yes, they adapt to price movement and volatility, offering better profit protection.

It helps manage risk more consistently but should always be tested.

Yes, TSC supports multiple signal providers simultaneously.

A stop-loss remains fixed at a set price, while a trailing stop moves with the market price, adjusting upward (or downward in short trades) to protect unrealized profits.

They work best when configured with volatility in mind.

Custom trailing stops adapt to market movements and trading strategies, while fixed stop-loss orders remain static. This flexibility helps traders capture larger trends, protect profits dynamically, and reduce early exits during normal price fluctuations.

Yes, TSC supports multiple signal providers simultaneously.

2 Comments