How TSC Equity Protector EA Shields Your Capital from Major Losses

If you’ve been trading for a while, you know that one bad move can wipe out your account. Maybe it was news you didn’t expect, or the market just moved quickly. Either way, your trades turned against you. And before you could react, your account was down.

Most traders lose money not because their strategies are bad, but because they don’t manage risk well. They let their losses run too far and react too late. They don’t have a solid system to protect their capital when things go wrong.

According to a 2023 report by the European Securities and Markets Authority (ESMA), between 74% and 89% of retail traders lose money when trading leveraged products like Forex and CFDs. One main reason is a lack of proper risk control, especially when copying signals blindly.

That’s where Equity Protector EA comes in. It acts as a safety net that monitors your investment and intervenes before a significant loss occurs. In this blog, you’ll learn why equity protection matters, how it works, and what TSC Equity Protector keeps your invested trading capital safe.

Why Equity Protection Matters: The Critical Role of TSC Protector

Using an equity-based protection system is vital for every trader to achieve consistent, emotion-free risk management. It limits drawdowns, safeguards capital, and helps ensure compliance with prop firm rules.

Whether you’re trading Forex, gold (XAUUSD), indices, crypto, or even stocks, the need for capital protection remains the most important thing. Each market comes with its own level of volatility:

• Sudden news spikes in the Forex market.

• Sharp reversals in gold prices.

• High-impact economic releases affecting indices.

Any of these factors can lead your trades to experience rapid drawdown. Without a drawdown protection system, your account equity can suffer major losses that can wipe out your trading balance.

Manual risk management often fails during fast market movements. And for copy traders, blindly following signal providers without safeguards makes the risk even worse. Just imagine you’ve invested your money in trading to earn a profit. But then, a sudden market moves or unexpected news event causes your trades to go against you.

That’s why the Telegram Signal copier team has developed TSC Protector EA to prevent excessive drawdowns and help traders keep their capital intact.

The Power of Automated Capital Protection

No matter what your trading style, whether you’re scalping in Forex, swinging gold, or copying high-frequency trades on indices or crypto, Equity Guardian or protector acts as an automated account guardian of your trading equity.

It is often referred to as a drawdown limit shield, which safeguards your trading equity by enforcing strict risk limits. When your equity hits a predefined threshold, the Drawdown EA takes immediate action to stop further damage.

Once triggered, it can automatically:

• Close all open trades to stop further losses.

• Prevent new trades from opening until equity recovers.

• Send alerts so you’re instantly informed of equity breaches.

This makes it especially valuable for professional traders, prop firm traders, and signal followers who demand precise control over capital exposure.

What is TSC Equity Protector EA? How does it work?

TSC Protector is an automated capital protection tool built to protect your trading account capital from major losses. This equity guardian EA creates a drawdown protection system that continuously monitors your account equity in real-time, ensuring that losses do not exceed your predefined limits.

By automatically closing all open and pending trades when equity falls below a set threshold, TSC Protector helps you avoid account wipeouts during high market volatility. It supports multiple trading instruments, including Forex, gold, indices, and synthetic assets, making it ideal for automated copy trading strategies.

If you’re into copy trading and following signals from Telegram channels, TSC adds a crucial safety layer to preserve your capital for long-term success.

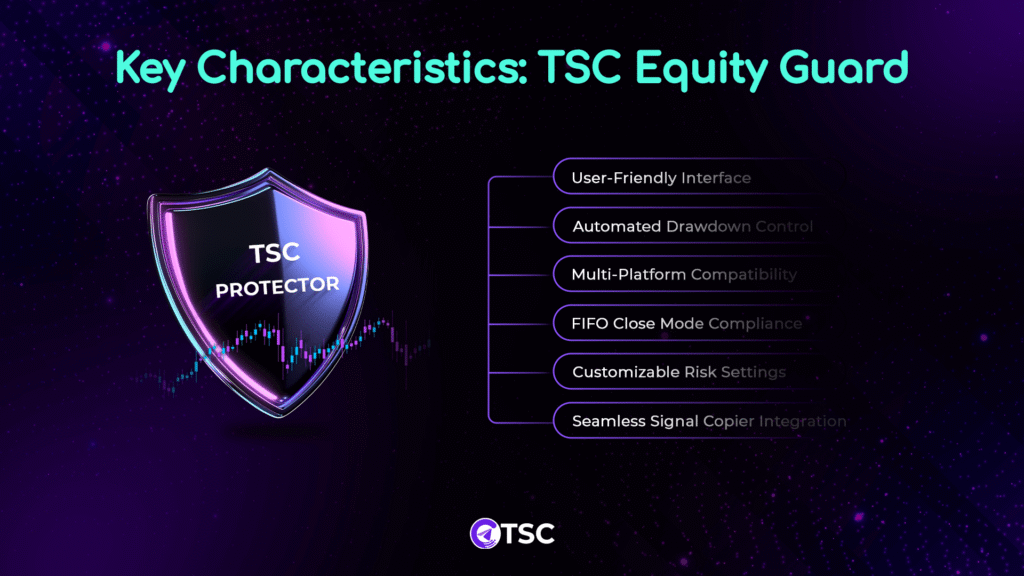

Key Characteristics of TSC Equity Guardian

TSC Equity Guard EA comes equipped with a comprehensive set of features tailored to protect your trading capital while enhancing your overall strategy execution. Here’s what sets it apart:

Key Benefits

Easy to set up for both beginners and pros, with easy setup and intuitive controls

Instantly protects your trading account by closing all trades when your equity falls below a preset level. No manual intervention needed.

Seamlessly works with Works with MT4, MT5, cTrader, DXTrade, and TradeLocker. popular trading platforms

Supports compliance with broker-imposed FIFO (First In, First Out) rules, which is essential for regulated environments.

Define your own equity thresholds to suit different risk appetites and trading objectives.

Built to work smoothly with Telegram-based signal copying systems.

What TSC Equity Protector EA Delivers for Traders

TSC Protector EA empowers traders with automated risk control by actively monitoring account equity and intervening before losses spiral. It takes the emotion out of trading and helps protect your capital across all market conditions. Whether you’re copying signals or trading manually, this tool keeps your equity shielded.

Here are some benefits of using the TSC Account Protector EA:

How TSC Protector EA Shields Your Capital Against Drawdowns

TSC Drawdown Limiter is an intelligent Expert Advisor designed to monitor, manage, and minimize equity drawdowns on MT4 and MT5 accounts. When you set up Telegram signal copier to your trading platform and Telegram channel, you’re adding a powerful account guardian that actively shields your equity from unexpected market shocks.

Here are the following steps on how TSC Protector guards your account capital:

1. Real-Time Drawdown Monitoring and Equity Control:

TSC doesn’t just look at your account balance—it continuously tracks live equity, factoring in floating profits and losses. That means it responds to actual market exposure, not just closed trade history.

Once your equity falls below a preset threshold, let’s say, a 10% drawdown, TSC automatically triggers protective actions to secure your capital.

2. Multi-Layered Drawdown Shield:

The TSC Protector EA deploys a flexible, layered system of defense tailored to your needs:

- Equity-Based Closure: All trades are closed when equity hits the loss limit.

- Profit Locking: If you’re in a significant profit, TSC can auto-close positions to preserve gains.

- FIFO Close Mode: Trades are closed one by one in the order they were opened to reduce the load gradually. This system is ideal for compliance with FIFO brokers or prop firm restrictions.

This multi-step protection is especially useful when managing positions, running high-frequency systems, or working within FIFO rules (e.g., for U.S. traders or FTMO traders).

3. Prop Firm Friendly Protection:

Passing prop firm challenges (like FTMO or FundedNext) often comes down to one thing: not breaching drawdown limits. TSC Protector helps you:

- Respect daily and overall loss limits

- Avoid emotional damage control during losing streaks

- Protect gains from being erased in volatile reversals

4. Profit Lock Mechanism

TSC Protector isn’t just about limiting losses. It is also designed to lock your profits. You can configure a profit cap where the EA exits all trades once your equity reaches a target gain. This prevents giving back hard-earned profits during volatile reversals.

5. Capital Protection for All Trading Styles

Whether you’re a scalper, swing trader, day trader, or signal copier, TSC adapts to your strategy. It provides structured, automated protection, ensuring your account never exceeds a tolerable level of risk, regardless of how aggressive or passive your trading approach is.

Who Gets Benefits from Using the TSC Protector?

Telegram signal copier Equity Guard is built for any trader who values capital protection, consistency, and peace of mind in volatile markets. Whether you’re managing one account or several, trading manually or with automation, TSC adds an essential layer of equity control that benefits a wide range of trading profiles:

• Prop Firm Traders (e.g., FTMO, The5ers, FundedNext)

Funded accounts come with strict drawdown rules. One violation can cost your entire account. TSC helps ensure you stay within those daily and overall limits by automating equity-based closures before it’s too late.

• Copy Traders and Signal Followers

If you’re copying trades from Telegram signals or other sources, you’re not in control of the entries. TSC acts as your backup defense, stepping in when signal quality drops or risk exposure increases unexpectedly.

• High-Risk Strategy Users (Grid, Martingale, Hedging)

If you’re using advanced strategies that stack positions or rely on market reversals, you need an equity firewall. TSC ensures you don’t wipe out your account due to runaway losses.

• Traders with Multiple Accounts

Managing several MT4/MT5 accounts? Use TSC across all terminals to enforce consistent drawdown limits and maintain risk control across the board.

• Retail Traders

For everyday traders, automated equity protection helps manage risk, especially when emotions and timing are difficult to control manually.

How to Set Up TSC Equity Protector

Setting up the TSC Equity limiter is straightforward and takes just a few minutes. To get started, purchase the Telegram Signal Copier Advanced package, which includes this powerful equity protection tool.

Once you have the package, follow the simple installation and setup instructions in this video:

If you need any assistance during the setup, our friendly client support team is available to help—just reach out via our website.

Why TSC Equity Protector Stands Out

When it comes to Forex equity protection, the Telegram Signal Protector stands out as the best automated equity protection solution for Forex, gold, indices, and crypto trading. With a Trustpilot rating of 4.5, TSC has earned a strong reputation for reliability and performance among traders.

Its real-time equity monitoring, multi-platform compatibility, and prop firm-friendly features like FIFO Close Mode and daily loss enforcement set this copier apart from other drawdown tools.

Unlike basic EAs that depend on delayed triggers or balance-based limits, TSC responds instantly to floating P&L, closing trades before drawdowns grow too large. It also supports profit locking, enabling traders to automatically secure gains, which many alternatives lack.

Built with precision and trader feedback, it offers strong protection against drawdowns, account wipeouts, and emotional decisions, making it one of the most effective drawdown EAs for MT4 and MT5.

How to Use the TSC Equity Protector Effectively

To maximize protection and performance, traders must understand how to apply TSC Equity Guardian in live environments. These usage tips help you trade safer, smarter, and within your risk limits:

- Set realistic equity drawdown levels that align with your risk profile. Avoid overly tight settings that could interrupt normal volatility.

- TSC Protector helps reduce loss impact, but it works best when combined with smart position sizing and leverage control.

- If you’re trading under U.S. regulations or with FTMO, enable FIFO close mode to stay compliant while protecting capital.

- In volatile sessions (like NFP, FOMC), consider temporarily adjusting thresholds to give your trades breathing room while maintaining capital safety.

Conclusion:

In trading, everyone focuses on how to make more money. But the real professionals focus on how not to lose it all. Whether you’re a beginner seeking safety nets or a seasoned trader managing risk on multiple accounts, TSC Equity Guardian delivers the confidence, control, and capital safety you need.

In short, TSC Equity Protector EA is for any trader who treats capital protection as a priority, not an afterthought. Whether you’re a beginner or managing six figures in funded accounts, TSC helps you trade smarter, safer, and more confidently.

Ready to protect your capital with smart automation? Get TSC Protector Now.

FAQs:

Equity Protector is a capital protection tool that monitors account equity and automatically closes trades when a preset drawdown or profit limit is reached. TSC has its own inbuilt account protector that helps prevent major losses in volatile markets or during automated trading.

Drawdown is the decline in your trading account’s equity from its highest value to a lower point during losing trades. It shows how much your capital has decreased before recovering. Managing drawdown helps protect your funds and reduce risk.

Yes, you can use Telegram Signal Copier’s Equity Protector on MT4 or MT5.

Forex trading involves high risk and frequent volatility. An equity fund protector ensures your account doesn’t exceed loss thresholds, helping you avoid margin calls, preserve capital, and meet prop firm drawdown requirements.

Yes. Telegram Signal Copier is designed with FTMO and other prop firm rules in mind. It includes features like daily drawdown tracking, FIFO close mode, and equity-based shutdown to help you pass and protect funded accounts.

Yes, TSC Account Protector automatically intervenes to prevent excessive losses.

Balance is your account value after all trades are closed. Equity includes floating profit or loss. TSC works based on equity, which is what truly matters during live trading.

Absolutely. You can define both targets. For example, close all trades if equity reaches 20% profit or drops to 10% loss.

Yes. It’s widely used by traders passing FTMO, FundedNext, and other challenges to ensure they stay within daily or total drawdown limits.

3 Comments