Scalping Vs Day Trading: Which Strategy Makes More Money?

Scalping and day trading are two of the most popular trading strategies, but each requires a different level of trading expertise. The main difference between scalp trading and day trading is in the trade duration. Well, there are many more differences.

So, whether you trade Forex, Gold, Indices, or Crypto, diving into the depths of these two common trading strategies can help you choose your best suitable trading style. Choosing the right strategies in trading matters more to gain profit goal.

However, in this guide, you will get a data-driven, non-hype comparison of scalp and day trade, covering:

- How each strategy works in real market conditions

- Profitability mechanics (win rate, expectancy, costs, consistency)

- Risk structure and psychological demands

- Which trading style fits different trader profiles in 2026

By the end, you’ll have a clear, practical answer to which strategy can make more money and which one is more realistic for profitable trading.

What Is Scalping in Trading?

Scalping trading is a short-term trading strategy that focuses on making profits from very small price movements. This strategy works by entering and exiting trades within seconds or minutes.

Traders who practice scalping in trading are called scalpers. Scalpers usually rely more on speed, accuracy, and precision than on patience and price swings.

Scalpers typically hold trades for seconds to a few minutes, relying on tight spreads and precise entries. They target small profits but place multiple trades in a day.

How Scalping Trading Works?

Scalp trading works by placing dozens or even hundreds of trades in a day and profiting from small price movements that add up over time. Scalp trading requires a higher execution speed with a high liquidity pool. As scalpers may execute hundreds of trades daily, it is also called a high-speed intraday trading style.

Scalping does not require holding prices and waiting for the market move. Instead, scalping success strongly relies on execution speed, high liquidity, and strict risk management to capture profits. It needs a keen understanding of the market and quick decision-making capability.

Scalping Trading Strategies

Scalping trading techniques include 1-minute scalping or 5-minute scalping, momentum scalping, or news-based scalping. These are-

- Breakout Scalping: This scalping technique is applied when strong support and resistance levels are identified on 1–5 minute charts. When the price breaks through these levels, orders with high volume are placed.

- Spread Scalping: In this strategy, both buy and sell orders are placed on both sides of the market to profit from the market spread.

- Momentum Scalping: This scalp trade is to enter trades in the direction where a strong price shift is confirmed. This can be defined by news or indicators like EMA, RSI, or MACD.

- Market Depth Scalping: Here, scalpers use Level II (order book) data to see where large groups of buyers or sellers are waiting. When the price moves toward these heavy buy or sell zones, the scalper enters a trade in the same direction to capture a quick move and exit.

- News-Based Scalping: In news-based scalping, trades are placed right after an economic news release. These news events often cause sharp and fast price movements, creating short-term trading opportunities.

- Algo-Trading: With higher-quality setups and ultra-fast execution speed, an automated trading EA can be one of the best scalping strategies. A properly backtested scalping EA can ensure profit by its sharp entry strategies.

Pros and Cons of Scalping Trading

| Pros ✓ | Cons ✕ |

|---|---|

| Frequent trading opportunities | High psychological pressure |

| Quick profits by smart entries | Needs tight spreads and commissions |

| Small moves add up larger profit overall | Requires excellent execution speed |

| No overnight volatility exposure | Not for beginners |

What Is Day Trading?

Day trading is the opening and closing of positions within the same day to profit from price fluctuations. Traders usually close all the positions before the market hour closes on the same day. These types of traders are called day traders or intraday traders.

Day traders usually take fewer trades than scalpers but hold positions for a longer timeframe than scalpers do. Day traders hold trades for minutes to hours and close all positions, avoiding the overnight market risk.

How Day Trading Works?

Day trading works by opening multiple trades and holding positions for minutes to a maximum of 24 hours. In day trading styles, traders usually use intraday charts, like 5-minute, 15-minute, and 1-hour timeframes, to find out opportunities and entry/exit levels.

A day trader can use higher leverage and margin as well to profit from small to rapid price movements. Intraday traders use technical indicators, from minutes to hourly charts, to trade, avoiding the overnight risks.

Popular Day Trading Strategies

Momentum, breakout, and scalping are some popular day trading strategies. Most of these intraday strategies are executed within the same trading day.

- Range Trading: This is a day-trading style that is done within a range. Defining the strong support and resistance levels, buy orders are placed at lower prices and sell orders are placed at higher prices, but the orders are always placed within the range.

- Scalping: Scalping is also considered a form of day trading, as orders are closed within the same trading day. Scalping is a too short-term trading strategy that carries higher risk.

- Momentum/Trend Trading: This is another day trading strategy where orders are placed following a strong price trend. This trend can occur after any news or volatility shift. For example, using the 100 EMA on the 1H timeframe and sticking to a place without countertrade.

- Breakout Trading: In this day trading strategy, orders are placed after anticipating a trend break and a strong directional move beyond the predefined support and resistance.

- Mean Reversion/Reversal Trading: In this day trading strategy, orders are placed against the existing market trend with an anticipation of the price returning to the average. RSI (Relative Strength Index) is used in this strategy.

Pros and Cons of Day Trading

| Pros ✓ | Cons ✕ |

|---|---|

| No overnight risk exposure | Lower to moderate risk |

| Same-day trading closed | All-day chart monitoring |

| Best for full-time active traders | Daily psychological tensions |

| Ideal for a highly active market |

Scalping Vs Day Trading: What is the Difference?

| Factor | Scalping Trading | Day Trading |

|---|---|---|

| Trade Duration | Seconds to minutes | Minutes to hours |

| Trade Frequency | Very high | Low to moderate |

| Profit per trade | Depends on skill | Small to medium |

| Market exposure | Extremely short | One day |

| Risk Level | Very high | Moderate |

| Transaction cost impact | High | Lower |

| Psychological demand | Intense, fast-paced | Strategic, patience-based |

| Capital efficiency | Very high | Moderate to lower |

| Best for | Experts | Beginner to intermediate |

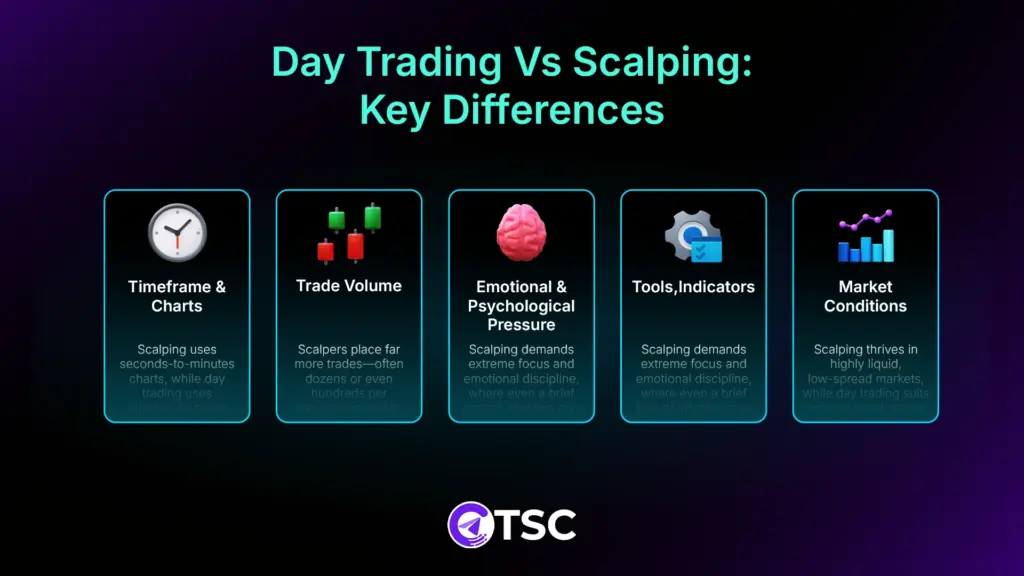

Day Trading Vs Scalping: Key Differences Explained

That said, timeframes and the trade volume are the key differences between scalping and day trading, but there are more when it comes to profitability. So, let’s break down all the differences between scalp trade and day trade below:

Scalping Vs Day Trading: Timeframe & Charts

Scalp trading is done using seconds to minutes charts within a very short timeframe, like 5 to 10 seconds or a minute, whereas day trading is done using minutes to hours timeframe. However, in both trading styles, orders are closed within the same day.

Trade Volume between Scalping and Day Trading

Though both scalping and day trading styles involve multiple trades in a day, scalpers execute a comparatively higher volume of trading than day traders. Scalpers place dozens to even hundreds of trades in some cases.

Emotional & Psychological Pressure in Scalp Vs Day Trade

Scalping trading psychology needs extreme emotional discipline and higher focus requirements compared to day trading. It needs constant monitoring of the charts, rapid decision making; a moment of focus drop can result in huge losses.

However, every type of trading requires emotional discipline, but scalpers need full concentration on the charts and monitoring. Sometimes, scalpers can not move eyes unless positions are closed.

Even the world’s best scalper, Fabio Valentini, confessed recently in a podcast about the pressure and ego to overtrade after a loss. But the key to success is discipline and emotional control.

So, when it comes to scalping vs day trading profitability, it entirely depends on traders’ skill, emotion, and risk control strategies.

Tools, Indicators for Scalping vs Intraday Trading

Scalpers often rely on real-time market data and Level II order books, Order flow data, and Time & Sales for market analysis. Execution speed is the most important factor in scalping.

On the other side, Day traders pay close attention to market-moving fundamentals, like the Economic data releases (CPI, NFP, GDP), central bank decisions and event releases.

In the case of indicators, day traders use a wide range of indicators like the Moving Averages, VWAP for intraday bias, RSI or MACD. While the scalpers use common indicators, like moving averages for momentum or volume spikes.

Scalp Vs Day Trade in 2026 Market Conditions

Scalping works best in highly liquid markets like major forex pairs, indices markets, and large-cap stocks, where spreads are tight and execution costs are low.

However, day trading performs best in markets with clear intraday trends, strong volatility, or sustained news-driven momentum.

Besides, in this modern trading automation era, AI-driven trading automation, like a trading algorithm, like the SureShotFX Algo, can ensure profitable trading in both scalping and day trading.

Scalping & Day Trading Risk Comparison- Which Strategy Is More Sustainable?

Scalping needs higher risk setups compared to day trading. However, for traders who are risk-averse, scalping is not suitable for them.

However, due to the short trade duration, scalpers face less exposure to market movements in comparison to day traders who need to hold positions for a longer period.

Again, in the cases of market crashes or sudden volatility hits, scalpers face more loss than day traders. 80-90% scalpers fail due to high-volume of trades. So, tight spreads are a must while scalp trading.

But day trading comes with comparatively lower risk factors, ensuring a higher win rate. Based on a FINRA report for 6 months of trading shows that around 13% of day traders were profitable and 72% fail due to poor risk management.

Is Scalping More Profitable Than Day Trading?

Scalping can be more profitable for highly skilled traders due to frequent trades. The profit target for scalp trading is smaller, but when it adds up as a whole, it becomes more profitable than that of day traders who spend almost an entire day on the charts.

However, when you calculate the risks, scalping comes with a higher risk potential than day trading. Scalping win rates range from 10-15% overall for skilled traders, especially on 5-minute charts.

Day traders can target higher profits with wider stop-losses. But without proper risk management and leverage, losing trades can impact more.

Research by the Journal of Financial Markets was done with around 450,000 individual day traders, where only 4,000 traders were consistently profiting. That said, day trading success rates hover at 30-60% overall.

Who Makes More Money: Scalpers or Day Traders?

While considering one from scalp trading vs day trading, proper risk management is the core role-playing factor. However, when comparing day trading vs scalping for beginners, day trading is more suitable and can be more profitable compared to scalping.

Simply put, scalping is more suitable for highly professional traders, experts with strict emotional control, and market analysis. High slippage, commissions, and mental pressure impact a scalper, so scalping win rate is mostly limited to $3-5 per trade.

Intraday trading is the best trading style for beginners, especially. A Reddit day trader shares that for him, the win rate is around 65% at 1:1.1 RR(Risk to Reward ratio), and 40% win rate at 1:3 RR with 15 trades per week.

Final Wrap

Now you are clear about the core difference between scalp trade and day trade. Each trading style comes with individual requirements and risk settings. But the right choice depends totally on your trading skill and experience.

As a beginner, you might not start with scalping, but you can start your day trading journey easily. And an AI-powered trade automation system like Telegram Signal Copier can help you copy trades with faster execution.

So, whatever market you trade, and if you use Telegram day trading signals for trading, you can enjoy the fastest trade execution using Telegram Signal Copier (TSC), trusted by 90,000+ traders worldwide.

Contact TSC support to learn more about copying day trading signals with the ultra-lowest execution latency.

FAQs

Yes, intraday is profitable, especially for beginners, but a proper risk management setup is a must.

No, intraday trading is not gambling if trading is done with proper market analysis and risk setup.

Scalping in Forex refers to a very short-term trading strategy to profit from small price fluctuations in the Forex market.

To become a scalper, you must be a quick decision-maker with strong market knowledge and emotional control while trading.

90% of day traders fail due to improper risk management and poor trading psychology- like overtrading or overleveraging.

Yes, $100 is enough for beginners to day trade, but proper risk control and leverage use are needed.