Is Copy Trading Profitable in 2026? Real Returns, Risks & Beginner Insights

Copy trading has become one of the most popular entry points for new traders in the financial markets. Instead of spending years learning technical analysis or following charts, traders can simply copy the strategies of professionals in real time.

But, is copy trading truly profitable in 2026?

The short answer: “Yes, copy trading can be profitable—but only when done wisely.”

According to industry research, copy trading activity has surged significantly over the last five years. Global reports indicate that interest in copy trading has increased by over 120% since 2020, with search trends rising nearly 20% year-over-year. This shows that more traders are considering copy trading as an accessible path into financial markets.

In this blog, we’ll explore real-world copy trading returns, the risks beginners must be aware of, and practical insights for those looking to maximize profits while managing risk in 2026.

What is Copy Trading? How Does It Work?

Copy trading is one of the simplest trading strategies that lets traders copy the trades of experienced traders in real-time. Instead of spending years mastering technical analysis or conducting their own market research, beginners can mirror the trading actions of skilled traders to participate in markets such as Forex, stocks, and cryptocurrencies.

Also known as mirror trading or social trading, trade copying allows copytraders to follow experts seamlessly.

Copy traders simply join their preferred signal provider’s Telegram channels and copy the trading signals manually or use an AI signal copier or copy trading apps.

When Copy Trading Works:

- When you pick a signal provider with a solid track record.

- The trader’s strategy aligns with your investment goal.

- The market conditions are favorable.

When Copy Trading Doesn’t Work:

- If the trader you’re copying is having a bad streak.

- When market conditions are fickle.

- You don’t understand the risks involved.

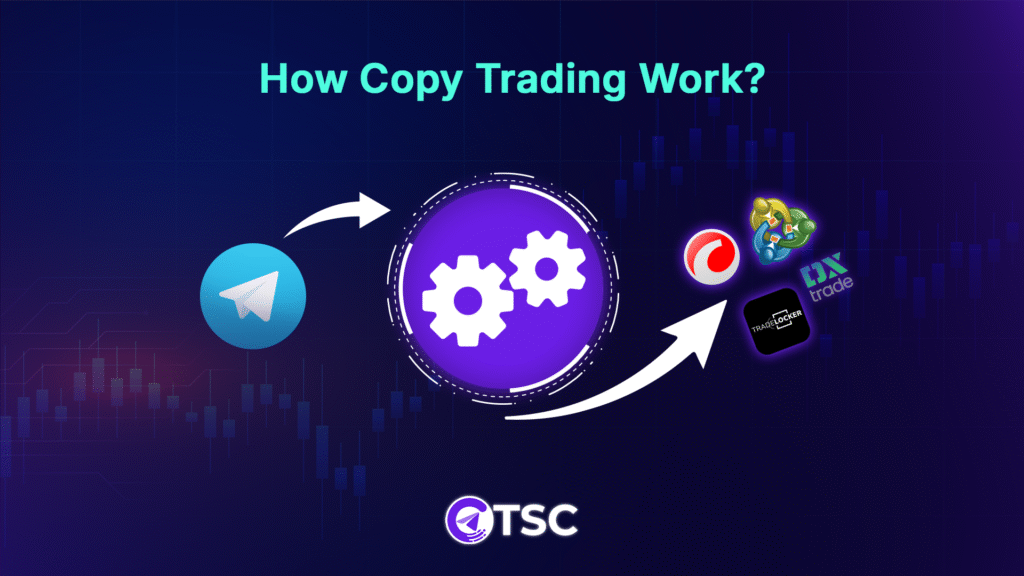

How Does Copy Trading Work?

Copy trading lets traders participate in financial markets without needing deep technical knowledge by simply following trades of professional copy traders. This method helps beginners gain market exposure, learn copy trading strategies, and manage risk effectively.

Here’s how copy trading works step by step:

Step 1: Choosing an Expert Copy Trader or Signal Provider

The first step in copy forex trading or other markets is selecting a reliable copy trader or signal provider from whom you copy the trades. Choosing the right signal provider ensures more profitable copy trades and a better learning experience for copy trading beginners.

Step 2: Join Copy Trading Channels

Most signal providers share their trade signals through Telegram channels. through dedicated Telegram channels. After subscribing to their channels, you’ll get access to copying trades in real time. Some channels are free, while VIP or premium channels provide exclusive copy trading services.

Step 3: Receive Trade Signals

After joining a copy trading Telegram channel, providers share signals in a clear and easy-to-follow format, making it simple for copytraders to replicate trades accurately.

Typically, a signal contains:

- The trading pair (e.g., EUR/USD, BTC/USD)

- Entry price

- Stop-loss and take-profit levels

- Buy or Sell direction

They design the signals this way so that copy traders can easily copy them either manually or through a Telegram signal copier to execute them automatically.

Step 4: Signal Execution

Once you receive trade signals from the signal provider’s Telegram channel, there are two main ways to execute them:

1. Manual Copy Trading:

In manual copy trading, traders manually input trade details into their trading accounts based on signals. However, this method often causes traders to act slowly, missing many profitable opportunities.

2. Automated Telegram Copy Trading Systems:

Automated systems, such as AI copy trading tools or copy trading apps, replicate the signals directly in your account. This ensures instant execution, reduces human error, and allows copy trading forex or crypto 24/7, even when you are away from your device.

Step 5: Monitoring and Adjusting

Even with automated copy trading, it’s important to monitor your copy trading account. Track the copy trader’s performance, adjust allocations, and use risk management tools like stop-loss and take-profit to protect your capital and maximize copy trade profits.

Pros and Cons of Copy Trading:

Pros:

- Beginner-friendly, ideal for beginners

- Saves time with automated copy trading

- Learn different copy trading strategies from seasoned copy traders

- Diversify across Forex, Gold, Indices, and crypto

- Use copy trading apps for 24/7 trade execution

- Low effort compared to manual trading

Cons:

- Profit depends on the performance of the signal providers

- Limited control over individual trades

- Fees or commissions on some copy trading platforms

- Market risk remains for copy trading Forex, crypto, or stocks

- Manual trade copying can be slow and prone to errors

Is Copy Trading Better Than Traditional Trading in 2026?

Copy trading is a game-changer because it simplifies the trading process. On the other hand, Traditional trading demands active involvement, effort, and trading knowledge.

Here are the key differences between traditional trading and copy trading:

| Feature | Traditional Trading | Copy Trading |

| Skills Needed | Analyze charts, select trades, and manage risk manually | Follow expert copy traders and replicate their trades |

| Time Required | High – continuous market monitoring and analysis | Low – automated or manual copying saves time |

| Risk | Full responsibility for all trades | Risk is shared; it depends on the performance of the copy trader |

| Learning Curve | Steep – takes years to master | Faster – learn copy trading strategies by observing professionals |

| Market Access | Requires personal research across Forex, crypto, and stocks | Instantly access markets by copying expert traders |

Is Copy Trading Profitable for Beginners in 2026?

Yes, copy trading signals can be profitable in 2026, but success depends on choosing the right signal provider, using reliable copy trading software or an AI signal copier, and managing risk effectively.

Here is why copy trade signals can be profitable:

- Beginner-friendly and time-efficient, allowing participation in financial markets without deep expertise.

- Following financial market experts helps replicate profitable trades while learning valuable trading strategies.

- Proper risk management and market awareness increase the chances of successful copy trades.

- Choosing the right provider and aligning with current market conditions can lead to consistent returns.

Many beginners find trading signals a great way to start trading, even without prior expertise, because it combines learning with practical market exposure.

Is Forex Copy Trading Profitable in 2026?

If you are thinking of starting forex copy trading in 2026, now is a great time. The forex market continues to expand year after year, creating more opportunities for traders at all levels.

According to the Bank for International Settlements (BIS) Triennial Survey, the global foreign exchange market is expanding steadily, and the average daily trading volume has reached over $7.5 trillion in 2022, up from $6.6 trillion in 2019.

Forecasts also show that the foreign exchange market could rise from $0.79 trillion in 2023 to $1.4 trillion by 2030, growing at an annual rate of nearly 8.7%. This massive growth shows the huge opportunities waiting for traders.

For beginners, copy trading offers a shortcut into this vast market. Instead of learning everything from scratch, new traders can copy the strategies of experienced forex traders in real time. Even seasoned forex traders are turning to copy trading as a way to diversify their portfolios, experiment with new strategies, and save valuable time.

So, copy trading for Forex in 2026 is a profitable choice for both beginners and experienced traders.

Can You Make Money With Copy Trading in 2026?

Yes, you can make money with copy trading in 2026, but profitability depends on the strategies you follow, how you manage risk, and prevailing market conditions. Copy trading provides a structured way for both beginners and experienced traders to replicate expert trades. But returns vary across traders and assets.

While profits are not guaranteed, copy trading offers a practical and structured way to participate in financial markets, learn from top traders, and potentially earn consistent returns.

Real Copy Trading Returns: What the Data Shows

Now the question is, “How profitable is copy trading in 2026?” Real-world data shows copy trading can be highly rewarding, but results vary. Recent reports suggest the potential can be significant.

- According to Bitget’s 2023 copy trading report, 93% of futures copy traders and 82% of spot copy traders were profitable, generating over 74 million USDT in total gains.

- Data from Finance Magnates also shows that many top-performing copy traders report average monthly returns between 5% and 15%, though results vary depending on risk appetite and chosen strategies.

- SureShotFX’s copy trading community’s real performance report gives a closer look at real-world outcomes. Between January and August 2025, SSF VIP copy traders recorded 21,298 pips with Forex signals, 28,415 pips with Gold signals, and 27,491 pips with Indices signals.

Risks and Considerations in Copy Trading

Even though copy trading can be profitable, beginners and experienced traders should consider the following:

- Market Risk: All investments are exposed to market volatility. Losses are possible.

- Provider Performance: Returns depend on the skill and consistency of the copied trader.

- Limited Control: Copy traders rely on the expert’s decisions, which may not suit everyone’s risk profile.

- Fees & Commissions: Some trading platforms charge fees, which can reduce net profits.

- Overexposure: Following too many traders or risky strategies can amplify losses.

Tip: Always start small, diversify across traders and assets, and use risk management tools like stop-loss or equity protection.

How to start Copy trading in 2026?

Copy Trade is an excellent way to mirror successful traders’ strategies. Starting copy trading in 2026 is simple and beginner-friendly. Here’s a step-by-step guide on how you can-

- First, choose a Forex Trading platform.

- Select a Forex broker who provides that trading platform’s access.

- Sign up for the copy Forex trading platform.

- Choose a reliable signal provider.

- Link your trading account to their Telegram channel.

- Decide how much money you want to invest.

- Finally, start copying the trades into your account.

If you want to automate this process and manage trades from Telegram channels seamlessly, you can use tools like Telegram Signal Copier. It helps you automate trades directly from Telegram signals, ensuring you never miss a trading opportunity.

Key Factors Need to Consider While Copy Trading:

Choose Good Traders to Copy Trade:

Check the trader’s history. How have they performed over the past months or years? Consistency is key. Your profits come mostly from traders you copy, not the platform. Use these tips to pick the best traders:

- Check long-term returns over many years.

- Seek low maximum drawdowns.

- Understand and like their trading strategies.

- Prefer traders active across different markets.

- Look for good risk vs reward history.

- Favor those with simple strategies.

- Avoid overtrading and inactivity.

Trading strategy:

It’s really important to understand the strategy the trade signal provider uses. First, try to determine if they are short-term traders or focused on long-term gains. Is it aligned with your risk tolerance and investment goals? Make sure their approach makes sense for you.

Risk Management:

- Market Risk: The market can be unpredictable. Always be prepared for ups and downs.

- Liquidity Risk: Sometimes, you might not be able to sell an asset quickly without a loss.

- Systematic Risk: Factors like economic downturns can affect the entire market.

Market Conditions:

Stay informed about current market conditions and trends. Different market conditions can significantly impact your overall trading flow. Sometimes you need to customize your trading strategy according to the situation to reduce losses.

Fees and Commissions:

Understand the fee structure of the trading platform you’re using. Platforms usually charge fees for copying Forex trades or managing your account. Some include subscription fees, performance-based fees, or spreads on trades. So it would be best if you make your own trading investment strategy.

What is the Best Strategy for Copy Trading?

The best strategy for copy trading in 2026 is to follow signals from a reliable provider, copy them in real time using automation, and apply proper risk management. This approach enables traders to replicate professional strategies while minimizing potential losses

One of the most effective ways to implement this strategy is by using a Telegram Signal Copier. This tool allows you to automatically copy Forex and crypto signals from top traders directly to your trading account, saving time and ensuring precise execution.

Why Copy Trade with Telegram Signal Copier

With Telegram Signal Copier, you get a complete solution for automated, precise, and versatile copy trading, covering every type of signal shared by professional traders.

- Automated Trade Copying: Automate expert trades instantly without manual effort.

- Customizable Risk Settings: Adjust trade size, stop-loss, and take-profit levels for safer trading.

- Lightning-Fast Execution: Trades are executed on your MT4 or MT5 account within 1–2 seconds, ensuring you never miss an opportunity.

- Universal Signal Parsing: TSC’s advanced Vision AI can interpret signals in any format—text, images, screenshots, and even non-English languages.

- Multi-Provider Support: TSC allows you to copy signals from multiple providers simultaneously, each with its own customized settings.

- Trusted by Traders: Rated 4.4/5 on Trustpilot with hundreds of positive reviews

- 24/7 Customer Support: Round-the-clock assistance via chat, email, and remote help.

Best Practices to Maximize Copy Trading Profit

Here are some copy trading tips for beginners in 2026:

- Start with a demo account and practice trading with the virtual fund.

- Don’t invest all your money at once. Start with a small amount to learn the ropes.

- Research the trade signal provider you’re thinking of copying. Look at their track record and trading strategy.

- Spread your investment across multiple traders to reduce risk.

- Keep an eye on your trades and the performance of the traders you’re copying.

- Stay informed about market conditions and news.

Conclusion:

In 2026, copy trading remains a profitable way for traders to enter Forex, crypto, and stock markets without extensive experience. By understanding the risks, choosing the right traders, and staying informed, you can increase your chances of success. Remember, every investment carries risk, so it’s important to make informed decisions.

Ready to take your trading to the next level? Start your copy trading journey today!

FAQs:

Copy trade means copying trades made by experienced traders. Instead of trading yourself, you copy the pros.

TSC ( Telegram Signal Copier ) is the best forex trade copier.

Yes, beginners can profit by following experienced traders, but results depend on the trader chosen and market conditions.

Real-world data shows average monthly returns of 5%–15%, though this varies by strategy, risk appetite, and market conditions.

Yes, it is legal in most places. Just make sure the platform and traders are regulated.

Yes, market risk is unavoidable, and poor performance of copied traders can lead to losses.

It can be safe if beginners carefully select reliable traders, use risk management tools, and start with small investments.

It’s relatively safe if you choose a trusted signal provider, diversify your investments, and apply proper risk management.

Yes, funds in your copy trading account can usually be withdrawn, depending on your broker or platform rules.

Yes, Prop firm copy trading is a popular choice among traders. But it’s important to check their specific policies.

Experienced traders may generate substantial returns, while beginners’ profits depend on chosen providers and strategy execution.

For More Information Contact Us Here