How to Use AI for Copy Trading to Boost Profits in 2026

What if a 1% market fall could become an 82% profit? That’s exactly what Tickeron’s AI trading agents did during September’s average 1.1% market decline. So, the use of AI in trading is changing the trading environment with more expectations.

But how to use AI for copy trading? Can that also be profitable to such an extent? Yes, it’s possible, with the right AI copier system, leveraging AI in profitable copy trading is no longer a dream but already happening.

Today, we will be talking about everything regarding the use of AI in copy trading across different markets and how it impacts different types of traders. So, let’s dig in!

What is Copy Trading?

Copy trading is a form of automated trading where one trader (“follower” or “copier”) automatically copies the trades of another in their own account. Benefits? You can enjoy profitable trades without any core expertise or analyzing the financial markets.

Actually, nowadays, copy trading has made trading easier and seamless for beginner traders. For example, if you are following any signal providers for trading Forex, you just need to copy their trades and place them on your trading account. And you profit from the same trade with others without any market or chart analysis.

So, copy trading works like-

→ If the traders you are following place a buy trade for gold, your account does the same

→ If they short the Nasdaq, you short too

It’s like putting your trading on “autopilot” by mirroring the strategies of people who already know the game.

What is the Role of AI in Copy Trading?

AI (Artificial Intelligence) plays a revolutionary role in copy trading with faster execution and zero human error. Advanced algorithmic AI systems and predefined strategies of AI help you to trade with confidence, avoiding emotional reactions.

Data Processing & Trade Recognition:

AI or ML (machine learning) systems can analyze far larger datasets (such as price history, volumes, social sentiment, news, and macroeconomic data) than a human could. These help in copy trading by automatically detecting the exact trade signals.

Market Prediction:

Along with trade signal copying, AI can attempt to predict market trends or when a copied strategy might underperform based on the trade histories. Research shows AI models like Random Forest and MLP can reliably predict short-term Bitcoin prices (Chen, 2023; Parente et al., 2024), which paved a new way for cryptocurrency trading.

Adaptive Strategies:

AI systems can adjust parameters (position size, stop loss/take profit levels, choice of traders to follow) dynamically as market conditions change. With customized risk management setups, AI can cap the losses and control drawdowns.

Speed & Automation:

With AI, copied trades can be executed instantly, removing delay, human error, or emotional impact. AI also allows 24/7 trade operation (especially important in crypto markets).

Risk Management & Diversification:

AI can spread risk across multiple lead traders, asset classes, and even strategies. It can monitor risk metrics in real time.

How Does AI Work in Copy Trading?

AI works based on predefined strategies and customizations. From automatic signal detection to fast trade execution, all can be done easily with AI.

Here’s how AI works in the case of copy trading:

- Signal Detection:

AI can automatically detect trade signals from any Telegram messages and collect signal data from the signals for faster trade execution. Some AI signal copiers can detect and copy the trade signals automatically without any human support. - Natural Language / Image Data Extraction:

Many signal providers send signals via chat, images, and screenshots. Al copiers can parse those to automate trade execution. Most of the advanced AI, like the TSC AI copier, can detect and copy signals from any image or any format or even any language. - Faster Trade Execution:

The main purpose of using AI in copy trading is faster execution, which prevents trade delays. AI can convert parsed signals into actual trades instantly and automatically place them on trading platforms (MT4, MT5, crypto exchanges, etc.), handling slippage and latency. - Consistent Strategy:

Advanced AI copiers, like the TSC, monitor risk management by using predefined risk control strategies. So, with AI, your trading strategy remains consistent without your monitoring. - Testing strategies & Analysis:

AI can analyse and save behavior on historical data and learn the strategies to estimate risk and returns for you.

How to Use AI to Maximize Profit in Copy Trading?

AI can maximize profit in copy trading by ensuring faster trade execution, leading to improved profitability and consistency.

Here is how profits are improved with AI use:

- Lower Latency & Slippage: Faster trade execution with AI means fewer missed trades. Copiers that copy trades from Telegram signals to MT4/MT5 platforms reduce the issue of manual errors in trading. According to some user reports for signal copiers, like TSC, real-time execution latency can go as low as ~70 milliseconds.

- Optimizing Trade Timing: Opening or closing trade positions a bit earlier/later based on predictive signals by AI can help secure more profits with the same strategies.

- Minimizing Losses: Identifying when a strategy is underperforming before losses grow too large, AI can control the drawdowns based on the history.

- Higher Win Rate & Consistency: AI can ensure a higher win rate and consistency in trading. With advanced AI copiers, trade consistency is maintained without interruption.

- Diversification and Portfolio Effects: AI can copy signals from multiple signal providers, maintaining a diversified portfolio for traders, particularly for beginner traders.

- Reducing Emotional Errors & Bias: Humans tend to overreact, but AI is emotionless. So, no chance of psychological impact on trade execution, leading to profitable and logical trades only.

- Adjusting Trade Size Dynamically: Based on risk assessment, market volatility, and correlation among assets, AI helps with learning the best AI trading strategies for beginners.

Pros and Cons of Using AI for Copy Trading

Though AI copy trading has numerous benefits, it comes with both benefits and drawbacks.

Advantages of Using Copy Trading AI:

- Automated, real-time trade execution

- No emotional bias

- 24/7 continuous trade execution

- Can manage multiple signals and trades

- Faster trade execution, avoiding delays

- No missed trades

- Diversification for better portfolio management

Disadvantages of Using Copy Trading AI:

- More AI dependency may perform poorly during a new regimen

- Any bugs in AI tools or technical issues can cause disasters

- Sometimes, AI trading strategies are not properly defined

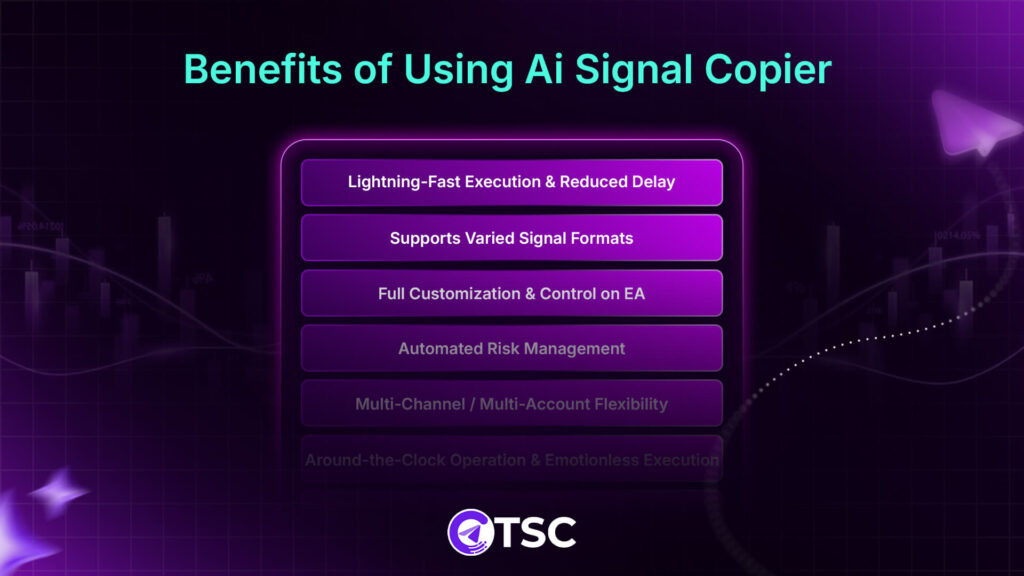

Why Copy Traders Use AI Signal Copiers? Reasons with Benefits

For advanced trading strategies and ongoing 24/7 trade execution, copy traders use AI-powered signal copiers. Signal copiers are already a gem in the financial market. But when combined with powerful AI technologies, it revolutionizes your trading game.

Here’s how:

Lightning-Fast Execution & Reduced Delay

AI signal copiers execute trades automatically as soon as a trading signal is received. This reduces missed opportunities and slippage that happen when trades are placed manually or with a delay.

Benefit: More consistent performance, especially for fast or short-duration strategies like scalping or day trading.

Supports Varied Signal Formats

Many AI signal copiers like TSC are designed to parse multiple signal formats: text, bullet points, images/screenshots, or even image-based signals.

Sometimes, even multi-language messages or forwarded posts are easily copied by an AI copier. They can extract trade details (entry, stop-loss, take-profit) accurately without manual input.

Benefit: You don’t have to retype or manually translate signals. Fewer manual errors, more flexibility in choosing signal providers.

Full Customization & Control on EA

With an AI copier, you can customize your own strategies and control how the EA (Expert Advisor) should work.

Advanced features like override or adjust stop-loss/take-profit levels, skip certain signals, set which symbols to accept or ignore, and apply filters like “only trades with defined SL/TP” or trailing stop based on SL-TP.

Benefit: Matches copier strategies to risk tolerance, trading style, or specific strategy preferences; gives control rather than a “black-box” approach.

Automated Risk Management

To protect capital, AI copiers frequently include more powerful and automated risk control features, such as fixed and dynamic lot size, risk-reward (RR) ratio settings, trailing stops, daily drawdown limits, time-based filters (e.g., only trade during certain market hours), ignoring signals during high-volatility periods, etc.

Benefit: Helps limit drawdowns, manage trade exposure, and maintain consistent risk settings across copied trades.

Multi-Channel / Multi-Account Flexibility

These AI copier tools often allow following multiple signal providers simultaneously and copying signals into multiple trading accounts or across different broker platforms (e.g., MT4, MT5, cTrader, DXTrade, etc).

Benefit: Diversification (different providers or markets), scale (managing more capital or more accounts with less manual effort).

Around-the-Clock Operation & Emotionless Execution

AI copier tools don’t sleep and don’t experience fear, greed, or FOMO triggers. Once an AI copier is set up, it continues to monitor signals and execute trades 24/7, regardless of the trader’s availability.

Benefit: Copies signals even when you’re offline, reduces human emotional bias and hesitation.

Potential to Profit Even from Poor Signals

Some AI copiers, like the Telegram Signal Copier, include a “reverse signal” mode when a signal strategy is weak or risky. The copy trading AI can reverse it and help to make profits from even a bad signal strategy.

Benefit: Adds additional layers of strategy to reduce risk or gain potential from less reliable signals.

How Using AI Signal Copier Benefits across Different Financial Markets

Based on different market volatility and movement trends, you can use AI signal copiers to maximize your trading profits and get the most out of a signal copier AI. Let’s break that down for different financial asset markets.

How to Use AI for Forex Trading

Forex trading needs ultra-fast trade execution to avoid slippage. The Forex market is an extremely volatile and fast-moving market. So, using AI for Forex trading can ensure faster copy trading with the lowest latency in execution.

Also, for profiting in the Forex market, use a Copier AI for Forex trading that has features for avoiding trades during news events. An AI signal copier like the TSC comes with all the mentioned features, along with advanced risk control features.

How to Use AI for Gold Trading

Gold is susceptible to news events and other macroeconomic events. So, using an AI copier for gold trading, you must ensure the copier has better risk-control features for the volatile market and can easily copy XAU (gold) signals.

With the advanced AI signal copier, you can trade gold with exclusive risk management features like the dynamic risk controls to customize stop-loss in real time during live market data.

Besides, the NLP (Natural Language Processing) system in AI copiers can scan and extract signals in any language and any format.

How to Use AI for Indices Trading

To use copy trading AI for indices trading, you don’t have to worry about the execution speed. Rather, the AI copier should avoid trading during high volatility (VIX) and lower liquidity. Besides, the Explainable AI (XAI) features in the AI copier can help learn the strategy and reason behind each trading signal.

The Financial Times report says about the successful launch of an AI-focused ETF (Exchange Traded Fund) through a Goldman Sachs-run platform in Europe for fund management.

So, make sure the indices copier has the Explainable AI (XAI) features and signal mapping for transparent and profitable indices trading.

How to Use AI for Crypto Trading

Crypto markets operate 24/7, are fragmented across exchanges, and are highly susceptible to regulatory news. So, using an AI copier with news filter features and continuous trade copy and execution without any interruption can help to copy crypto signals easily without delay.

Telegram Signal Copier Pro AI features can dynamically analyze the market and, based on that, maintain a consistent strategy in the crypto market. Again, the crypto market is extremely unpredictable, so a wrong move in cryptocurrency trading can drastically cause a huge swing.

But using AI for crypto trading ensures trade automation and emotion-free, error-free trading every time.

How AI Signal Copier Helps Different Trading Styles?

Ensuring ultra-fast execution for the scalpers to the long-term swing traders with continuous monitoring is supported by an AI signal copier. For different trading styles, the AI signal copier plays a variety of roles. Such as:

• Day Trading: Day trading needs daily opening and closing of a position in the market, along with daily basis chart monitoring. So, an AI signal copier can execute a trade daily with 24/7 continuous monitoring and tight stop-loss features.

• Swing Trading: In swing trading, a trade is held for a few days to weeks. So, an AI signal copier with its continuous trade running feature and news filter can avoid placing any new trade during a news event. Also, the AI swing trading copier can monitor and close a position based on your preferred risk control setups.

• Position Trading: This type of trading needs patience, as it requires long-term position holding. Fewer trades, but risk management is focused on macro regimes. AI copier, with its advanced technology, guards every trade against regime shifts and avoids psychological impact during holding a trade for a longer time.

• Scalping: Scalping trading is different from other trading styles. It is a very short-term trading that needs instant trade opening and closing. And this type of automation with ultra-fast execution is perfectly possible with an advanced AI copier system.

• Prop Firm Trading: Though some proprietary firms don’t allow copy trading, you can use modern AI copiers to protect your prop firm equity and cap the drawdowns. The TSC advanced AI copier comes with such an advanced drawdown EA to help you pass prop firm challenges without copier detection.

What is the Future of AI in Copy Trading?

The future of AI in copy trading is going to be revolutionary and more advanced. AI trading platform market insights show that.

“AI Trading Platform Market is growing from USD 11.49 Billion in 2025 to USD 54.42 Billion by 2034.”

Here’s how AI is going to bring a new track in copy trading:

- AI can help in creating advanced and highly personalized portfolios

- All-in-one integration of copy trading, social trading, and an AI-advisory system

- Adaptive AI to adapt to different trading strategies

- An advanced AI system can automatically learn to set the risk setups based on historical data

- Voice-assistant AI agent to make copy trading more advanced

- Automatically monitor risks and manage to create diversified portfolios

How Can TSC AI Copier Lead the Future of Copy Trading?

TSC- Telegram Signal Copier with advanced and modern AI features not only makes trading automation smoother but is also best for everyone, from beginner traders to busy professionals.

From basic trade automation features to advanced and dynamic risk setups, automatic trade closing, and trade time based on a definite schedule, TSC is leading and is going to lead the copy trading journey.

Besides, TSC is always working with advanced AI technology to make your trading automation easier, more seamless, and more manageable.

Conclusion

AI is not a magic bullet, but when used thoughtfully, it can transform copy trading, making it more consistent, efficient, scalable, and accessible.

Whether you are a beginner trader or an experienced one looking for hedging or portfolio management, contact the TSC Support team to learn more about how to use AI in copy trading to maximize profit return.

FAQs

TSC- Telegram Signal Copier AI is the best AI copier tool for trading automation.

Of course, you can use AI for trading- either an automated trading bot within MetaTrader platforms or a dedicated AI copier EA.

Absolutely. AI copy trading is safe for beginners and even for experienced traders.

No, AI can’t guarantee profits in copy trading, but AI can ensure seamless copy trading and trading automation without any manual errors or emotional decisions

Overcustomizing, blindly relying on AI without verifying the signal providers, and not checking tool performance are some common pitfalls when using AI in copy trading.