How to Remove Emotions from Trading: Master Your Trading Psychology

80% of retail traders fail due to emotional biases, not a lack of trading strategy. But if you can learn how to remove emotions from trading, you can overcome most of the causes for your trade failures.

Emotions like fear, greed, hesitation, stress, and overconfidence force a trader into impulsive trading decisions, causing consistency to break. So, learning to control your emotions in trading is crucial.

Therefore, in this comprehensive blog, we have discussed trading psychology and every practically proven way to manage fear and greed in trading, and how to trade without emotion for long-term trading consistency.

Let’s start!

What is Trading Psychology?

Trading psychology is the study of emotional reactions or factors, such as fear, greed, and impatience, that influence trading decisions. Trading psychology reveals whether traders can stick to their trading plan, ignoring emotional factors, or easily become reactive and inconsistent.

It is basically a trader’s mindset or emotional bias. It’s the feeling or thinking about how you feel or how you react when executing a trade. It’s the behavioral state that shows how your mind reacts under volatile market stress.

Things to Know: What are the Common Emotional Biases in Trading?

Fear of missing out (FOMO), greed, panic, overtrading, overconfidence, revenge trading, and irrational decisions are some of the most frequent emotional biases that affect a trader’s performance.

Trading psychology is more of a skill than a strategic term in trading. Maintaining a strong mindset with solid control over your emotions can help you trade with consistency. On the other side, a weak and out-of-control mindset can lead to only losing trades.

Why Trading Psychology Matters

A disciplined mindset is important for greater trader discipline profits. Most of the successful traders consider trading psychology as one of the most important parameters to define a successful trader.

Actually, a strong trading mindset not only helps a trader in making trading decisions without emotion but also leads to long-term consistent success. Understanding and learning to manage trading emotions can significantly improve the overall trading performance.

Ignoring trading psychology can lead to-

- Higher Trade Failure Rate: Without strong control over the mindset, it can lead to a higher loss rate. Yes, you might not even realize how much losing trade you are taking daily. Eventually, your trade failure rate increases, causing a bad impact on the account portfolio.

- Uncontrolled Trading: Trading includes a rollercoaster of emotional factors, particularly greed, fear, hope, regret, FOMO, and so on. When you don’t have control over your emotions, your trading gets uncontrolled too.

- Less Trading, More Gambling: Without trading psychology strategies, your trading becomes no longer trading but gambling. It’s because trading includes fundamental and technical analysis, along with strong emotional control.

- Unexpected Risks: You have done a solid market analysis, but without any control over your emotions, every strategic trade leads to unexpected risks. Trading psychology helps you maintain your risk principles, such as setting stop-losses, using lot sizes according to capital, and not risking more than 2% of total capital.

- Indiscipline & Inconsistency: Success in trading involves strong trading discipline and consistency. But without removing emotional impacts from trading, your trading becomes inconsistent, and there remains no disciplined strategy.

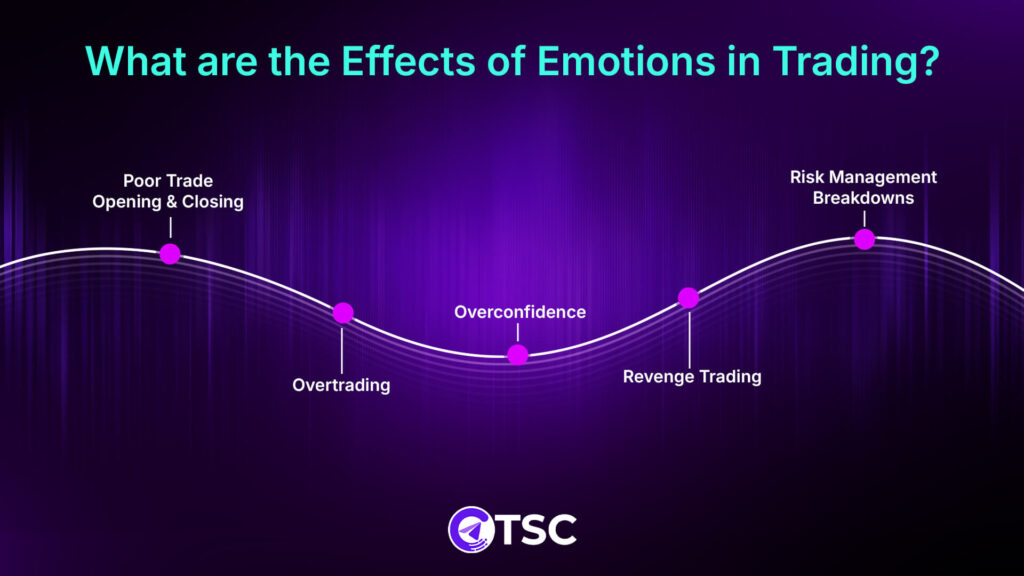

What are the Effects of Emotions in Trading?

Impulsive trade executions, overtrading, and breaking risk rules are some common dangerous effects of emotions in trading. Greed for more profits while going against the trade rules or overconfidence leads to poor trade outcomes, resulting in higher risks.

However, some particular effects of emotions in trading are as follows-

- Poor Trade Opening & Closing: Fear Of Missing Out can lead to opening unanalyzed trade positions in fear of losing a chance of profitable trades, while it might turn out the opposite. Again, fear can lead to closing any trade too early, while strategies say holding the trade might lead to more profits.

- Overtrading: During highly volatile periods, the stress remains higher, especially when a few trades hit the stop losses only. This gives you anxiety and distracts you from trading plans, and makes you fixated on losses with overtrading.

- Overconfidence: When you can’t have control over your emotions, it can lead your beliefs to be driven by your emotions rather than strategies or market insights. This led to overconfidence with unrealistic beliefs.

- Revenge Trading: Regret of losing or missed opportunities can lead to unplanned trade execution, which is called ‘revenge trading.’ Research shows that this also causes more impulsive trade decisions with more losses.

- Risk Management Breakdowns: Without discipline and control over emotions, risk management becomes uncontrolled. Your emotional state can make you risk more than your capital or manually move your stop-losses (SL).

How to Remove Emotions from Trading? 7 Proven Ways

Always sticking to your trading strategies, using risk-management tools, and taking breaks are the key to remove emotions in trading. You can’t stop your emotions, but building a systematic habit to avoid emotional impact is possible.

And what author Mark Douglas said is legit: just telling yourself to maintain disciplined trading is not enough. Making a habit of it is the only way to emotionless trading.

Here are some detailed strategies proven by successful traders:

1. Build a Rule-Based Trading System

Create your own trading plan to avoid emotional decisions and strictly stick to your trading plan, no matter what your heart says.

Why This Matters: A well-structured rule means every trading decision taken by you must be based on logic and should not depend on your emotions or how you feel during trading.

According to a Qualitative Study by MDPI,

“Around 42% of traders were found with impulsive trade decisions only because they were influenced by emotions, especially while trading under heavy stress.”

How to Build:

- Define your entry options, like using specific charts for specific assets, indicators, or any other filters you should use.

- Set your stop-loss discipline, like always using stop losses (SL) and how much Take Profit (TP) you want, or what your capital account balance allows.

- Keep a standard trade position size according to your account balance. Highlight how much risk you want to take for each trade based on your total account. Make that risk percentage for each trade mandatory for every trade you take.

- Highlight the time when you don’t have to trade, no matter how profitable the market looks. Mention the events like major news events, economic releases, or volatile market times.

- Be specific on the maximum trade to keep open according to your capital investment. Specify trade frequency and risk for each asset fixed according to the total account.

2. Use Predefined Risk Management to Control Trading Emotions

Fix a risk per trade as a pre-trade checklist for emotional control, and always use that predefined risk percentage.

Why This Matters: When your risk permit is fixed, the emotional factors like fear, FOMO, greed, etc., can be easily avoided. 2024 study by ESMA (European Securities and Markets Authority) reveals that inconsistent position sizing increases the margin calls by up to 68%.

According to different psychology researchers, stress hormones get triggered when perceived risk is high, which causes panic decisions and impulsive behavior, impacting trading as well.

How to Build:

- The rule of thumb is not to risk more than 0.5%–2% of your total account balance for every trade until it’s consistent.

- Never increase lot size after continuous losing trades

- If possible, use a position size calculator or a lot size calculator before placing every trade.

3. Keep a Trading Journal to Reduce Emotions

Write down your trade entries and the strategies. Also, write down your emotional state before and after placing the trade.

Why This Matters: Journaling is a scientifically proven way to reduce emotional reactions. Let’s say you are having grudges against any person or topic; just keep writing about your grudges, and after that, you will see that you are feeling lighter and better. No emotional reactions!

Trading studies also show that traders who follow a trade journal can recognize the market patterns better and overcome revenge trades. This is pretty similar to the techniques used in Cognitive Behavioral Therapy (CBT).

That’s why Mark Douglas said in his best-selling book, ‘The Disciplined Trader,’–

“Learning to accept the risk is a trading skill—the most important skill you can learn.”

How to Do It:

- Write down your emotional state before opening the trade position

- Note down whether you followed your predefined rules or not

- Analyze and write down your emotional state after the trade closes

- Review your trade journal every week and identify the market pattern for further improvement.

4. Reduce Your Chart Monitoring Time

This is essential for detaching yourself emotionally from your trading account. Limit your screen time or the duration of staring at the charts for calm trading and ensure complete trading focus.

Why This Matters: Too much screen time can cause fatigue and also be injurious to your eyes and overall mental state. Long periods of chart monitoring can reduce decision-making quality and make you easily influenced by emotions.

So, the more screen time you have, the greater the emotional effect will be on every movement.

How to Do It:

- Fix a time for how long to stare at the screen and those charts

- Take a break after a few hours of screen time

- Place your trades and take a break. Only check the charts at predefined intervals

- Never keep analyzing your trades at midnight

- Don’t keep analyzing the charts after being exhausted by trade results

5. Backtest Your System for Confidence

Test your trading strategies and predefined rules to develop trust in yourself.

Why This Matters: Backtesting is crucial for building confidence in your trading setup. When you test your past strategy, it increases confidence and gradually reduces the emotional factors, such as fear or FOMO.

Surveys show that traders who backtest strategies achieve 37% more consistency in their trading than those who rely solely on intuition.

How to Do It:

- Backtest a minimum of 6 months to a few years of trading data for each pair.

- Note down the win rate, average RRR(Risk-Reward-Ratio), and max drawdown reached.

- Backtest your strategies on a demo account for at least 30–90 days to ensure the strategy.

6. Automated Tools and Systems to Reduce Emotion in Trading

Automating trades can give you an edge to avoid emotional trading mistakes. Use any trade automation tools, like signal copiers or Expert Advisors (EA), as an emotionless trading strategy.

Why This Matters: Automating your trade entries and risk settings can ensure emotionless trading without any manual errors. A survey by the CMT (Chartered Market Technician®) association found that traders opting for automated trading systems can reduce emotional trading mistakes by up to 83%.

How to Do It:

- Use automated tools like signal copiers, EAs, and strategy-based trading Algo bots to execute your trades without emotion.

- Automate repetitive tasks, like the stop-loss or lot size settings.

- Automate your trading schedules to have disciplined trading every time.

- Keep mobile notification alerts for automation updates when you are away or take a break.

7. Learn to Admit that Losses are Obvious

You have to admit that losses can happen, and there will be losses, to keep your feelings less responsive when a trade hits the stop loss.

Why This Matters: When you fear losses, you decide based on emotions rather than strategies. But if you can accept losses positively and admit losses are usual, just like the business operational cost, your trading becomes mechanical and fully emotion-free.

A 2023 behavioral study by Harvard Business School found that people are twice as sensitive to losses as they are to achievements.

How to Do It:

- Always make yourself admit that losses are a part of your trading success

- Set a weekly maximum drawdown limit

- Always focus on the long-term edge, not on the single outcomes

- Train your brain to admit that losses do not define your trading skill, but consistency does.

Emotional Trading Vs Systematic Trading

Emotional impact is the key difference between emotional trading and systematic or algorithmic trading. Here are the major differences-

| Aspect | Emotional Trading | Systematic Trading |

|---|---|---|

| Emotional Impact | Higher | Emotion-free |

| Risk Management | Inconsistent | Fixed & consistent |

| Trade Frequency | Sometimes overtrading | Fixed, based on the criteria |

| Decision Process | Based on emotional factors like fear, greed, and FOMO | Predefined rules & strategies based |

| Flexibility | Higher | Lower, rules-based |

What are the Best Tools to Remove Trading Emotions?

The Telegram Signal Copier (TSC) tool is the best tool to remove trading emotions and automate your trading signals from Telegram to MT4/MT5/cTrader/DXTrade/TradeLocker. With advanced AI technology use and customizable risk settings, TSC allows traders to execute trades free from emotional mistakes, such as greed for more profits, revenge trading, or FOMO.

In 2024, a study by the London School of Behavioral Finance found that when emotional decision-making was replaced by automated trade decisions, the overall performance was improved by around 58%. And this is where TSC becomes the ultimate solution to emotional trading mistakes.

Why Choose Telegram Signal Copier for Emotion-free Trading?

With over 90,000 users worldwide, Telegram Signal Copier (TSC) has become one of the fastest-growing and most trusted copy-trading solutions in Forex, Gold, Indices, and crypto trading.

- 24/7 trading without emotional impact

- Instant and live trade copy and execution

- Can copy and execute any format, any language signals

- No trade signal missing, no trade delays

- Fully customizable risk settings

- Reverse trading signals to flip the losing trades

- Custom balance set to cap the risks and overall account

- Complete signal history to track every copying trade

- 24/7 live customer support for any assistance

- Drawdown protector EA (Expert Advisor), particularly for prop traders

Plus, this Black Friday season, TSC is being highlighted by top news portals for a Mega Sale of up to 75% OFF. Make your mindset shift from emotional trader to disciplined trader with the strong AI-powered Telegram Signal Copier!

Conclusion

Learning how to remove emotions from trading does not prevent emotions from entering your mind. But this helps in developing a strong trading psychology to avoid emotional biases to ensure long-term trading success.

And it is proven that once you can build a habit for emotion-free trading, higher consistency is ensured. And nowadays, tools like TSC help in automating trade execution and avoiding emotional swings.

Learn more about how to get TSC for FREE!

FAQs

Focus on a predefined trading checklist and risk settings for consistency and to avoid emotional impact. Besides, using an automation tool like the TSC AI copier can help trade without emotions.

You can’t stop emotions, but avoid them by following a trading journal and strictly managing risk according to your capital while trading.

Never risking more than 1% of your total account balance is the 1% rule in trading.

Yes, research and different behavioral finance studies show that trading is 90% psychology. But it can be avoided with disciplined trading strategies and emotional control, particularly for retail traders.